The sales receipt is a document that typically contains the date and time of purchase, details of the item purchased, the purchase price of items and totals, obligatory information about the return policy of sales, and method of payment. Sales receipt helps you to calculate sales tax on the products and it will help you to create a summary of sales income and sales tax owed. The sales receipts will help you to record daily or weekly sales and present them to those customers who make full payments against purchases. If the customer pays some advance then it will not be good to use sales receipts. Sales receipts are only used in cash sales and require full payment at the time of record sales. If you want to satisfy all customers and want to maintain the accuracy of sales registers then you have to design a standard sales receipt.

Uses of Sales Receipt

- It will be used at the time of full payment against goods and services.

- It is necessary to track total sales of the week, day, month, and annual year.

- It will help you to track the sales tax you collected and owe.

- It is essential to create daily or weekly summaries of sales income and sales tax owned instead of on a “per sale” basis.

- If you are using a sales receipt then there is no need to accept advance payment.

- There is no need to track what your customers owe you.

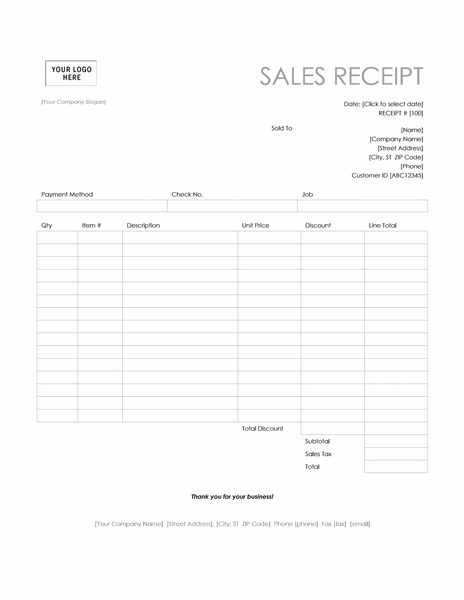

Here is a preview of this Free POS Sales Receipt Template created using MS Word,

Businesses Using Sales Receipts

Beauty sales, pet groomers, newspaper stands, dry cleaners, restaurants, cloth merchants, grocery stores, etc. use sales receipts to track the accurate record of the sales of their business. If you are a vendor offering supplies, retail store, or gas station then you will use the services of a sales receipt. Sales receipts are individualized according to the required information of the company according to its needs.

Contents of Sales Receipts

- Sales receipts should contain the business name, address, contact details, and URL of the company. It should contain your logo because it will serve as the best marketing tool for your business. It will be an official norm to include a public service greeting or a thank you note for the customers for business with you.

- The date of the transaction is also necessary so list it in the top right corner of the sales receipt. You should mention the serial number or transaction number on the sales receipt so that you can track any important data without any problem.

- The product description is equally necessary and is often generated from barcoding. This will help you to get the proper record of inventory sold during a specific period. The cost of each item should be written on the sales receipt so that you can get the total amount and the percentage of sales taxes.

- You can use POS (Point of Sale) systems to get the electronic record to monitor every transaction. It will prove helpful to scrutinize the stock or keep a log of inventory in an automated fashion.

Here is the download link for this Free POS Sales Receipt Template,