So many people are staying hardly in front of the mounting heaps of bank statements that they get monthly. It’s incredible how fast they stack up and just how much space they use up. Here I am sharing this wonderful Bank Statement Template to help prepare your bank statement easily.

Use of the subsequent tips can be applied to your plight that can help to arrange your bank statements. Managing your bank statement indicates verifying your checkbook data goes along with the lending institution’s information of the bank account. It can help stop bank account borrowing, draw bank glitches, and stimulate cost management, and it is quite simple.

Learning how to go through your bank statement allows you to identify mistakes made by you or even the financial institution – like an unrecorded check or possibly a left-out deposit – and also what could be unrecognizable charges. Bank statements give helpful details. Understanding how to carry out a comprehensive evaluation of the bank statement may help to make sure that you stay securely in charge of your money and therefore are in a position to talk with your bank when a difference occurs.

In the past times, verifying and managing the bank statement when it started in the postal mail was satisfactory. Today, with monetary dealings happening quickly and the perils of identity fraud, it’s wise to gain access to your web banking attribute and frequently check your record for any mistakes.

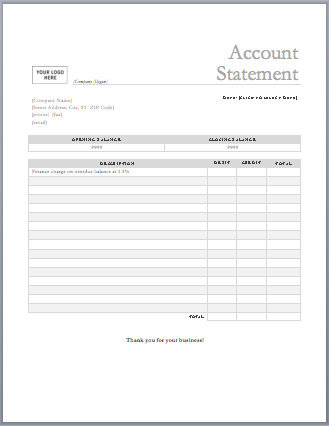

Free Bank Statement Template

Here is a preview of this Bank Statement Template in MS Word 2010.

Checking up your money usually takes only a few clicks of the mouse, and because the procedure needs no stamping or emailing it’s a favorable decision as well. Access the lender’s website and sign up your bank account for Internet banking. At first, you’ll need your savings account number. Because of safety challenges, the financial institution will give you thorough steps to ensure the identification.

Bank Statement Guidelines

A few banks validate you by email or telephone just before permitting the first entry to your Internet banking. After you have fixed up a security password and log-in Identification and the process recognizes the computer’s Internet protocol address, you ought to have immediate access to the accounts from there on.

Start the bank statement at the earliest opportunity. The financial institution often features a set period limit for confirming mistakes. For differences concerning debit cards, a web-based deal, or other automated bank operations, the amount of time limit usually is two months. Such limitations usually do not affect hand-written inspections, however early stating of any problem is recommended.

Evaluate the sections describing interest piled up. Banking institutions provide both interest-bearing checking out financial records and people who have no interest. In case you popped an interest-bearing bill yet the statement implies otherwise, you’re very likely to get the miscalculation.

Here is the download link for this Account Statement Template,