An operating statement also referred to as a profits record or cash and deprivation statement is a monetary statement featuring a firm’s net profit or net sale loss for the number of months. The operating statement also referred to as an income and loss report or a revenue record is a crucial fiscal report used by all businesses. A practical report is usually worked out right after every 4 weeks and also yearly. This specific statement indicates a firm’s profits and expenditures and figures a firm’s net income or net deprivation for several months.

Income: The operating statement provides all of a firm’s profits. Profits are available from several resources, like profits and interest cash flow. Just about all profits are outlined, and a total is usually computed.

Major Profit Markup: For companies or businesses with stocks, a bank account known as valuation on products sold can be used. This specific amount of money shows up and subtracted from the income. The primary difference signifies a firm’s total profit difference. Expenditures: All costs, like devaluation expenditure, rent payments expenditure, and utilities expenditure, are shown separately on the operating report.

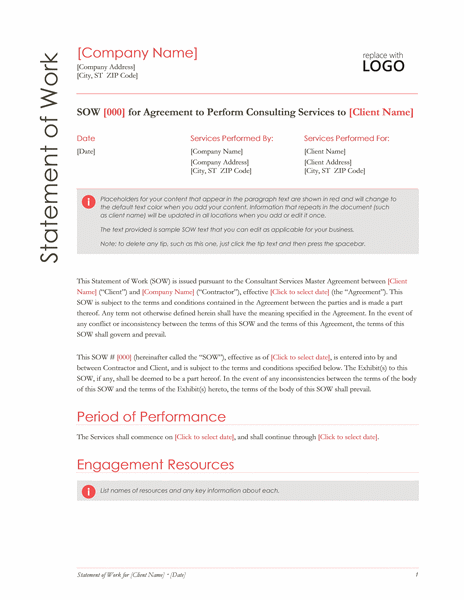

Here is a preview of this Operating Statement Template created using MS Word 2013,

The actual expense shows up and is then deducted from the total income markup.

Net Profit: In the end, computations are executed, and the conclusion on your operating statement signifies a firm’s net income or total loss. This amount of money is utilized by traders to investigate a firm’s productivity.

Write your report title, the business title as well as the date your report is geared up. The facts are recorded on the proper execution and crank out your operating statement. You may need the fiscal info of your company, like all income and expenditure volumes, to prepare this document.

Record all of the profits from the business that took place throughout this specific time frame. This consists of net product sales volumes, leasing earnings, and interest profits. Accumulate the whole profits and put the total below all profits goods.

Write in the price of items offered in the market. This quantity is utilized for businesses with inventories and production businesses and signifies the entire price of the products the organization offers. Subtract this quantity from the income quantity. This quantity signifies the firm’s gross revenue margin.

Check the list of all costs independently. Each cost an organization has is outlined on the working assertion, such as depreciation costs, lease costs, and wage costs. In the end, costs are outlined, symbolizing complete costs.

Deduct the whole cost amount from the particular total income markup. This specific amount demonstrates a firm’s net income or net deprivation. In case the total profit amount is more than the cost, the business carries a net income. In case the total earnings amount is leaner than the cost, the business undergoes a net sale loss. Your total revenue or deprivation sum is a crucial amount for businesses. Proprietors, shareholders, and other stakeholders evaluate a business by applying this sum along with other sums to figure out the fitness of a business.

Here is the download link for this Operating Statement Template,