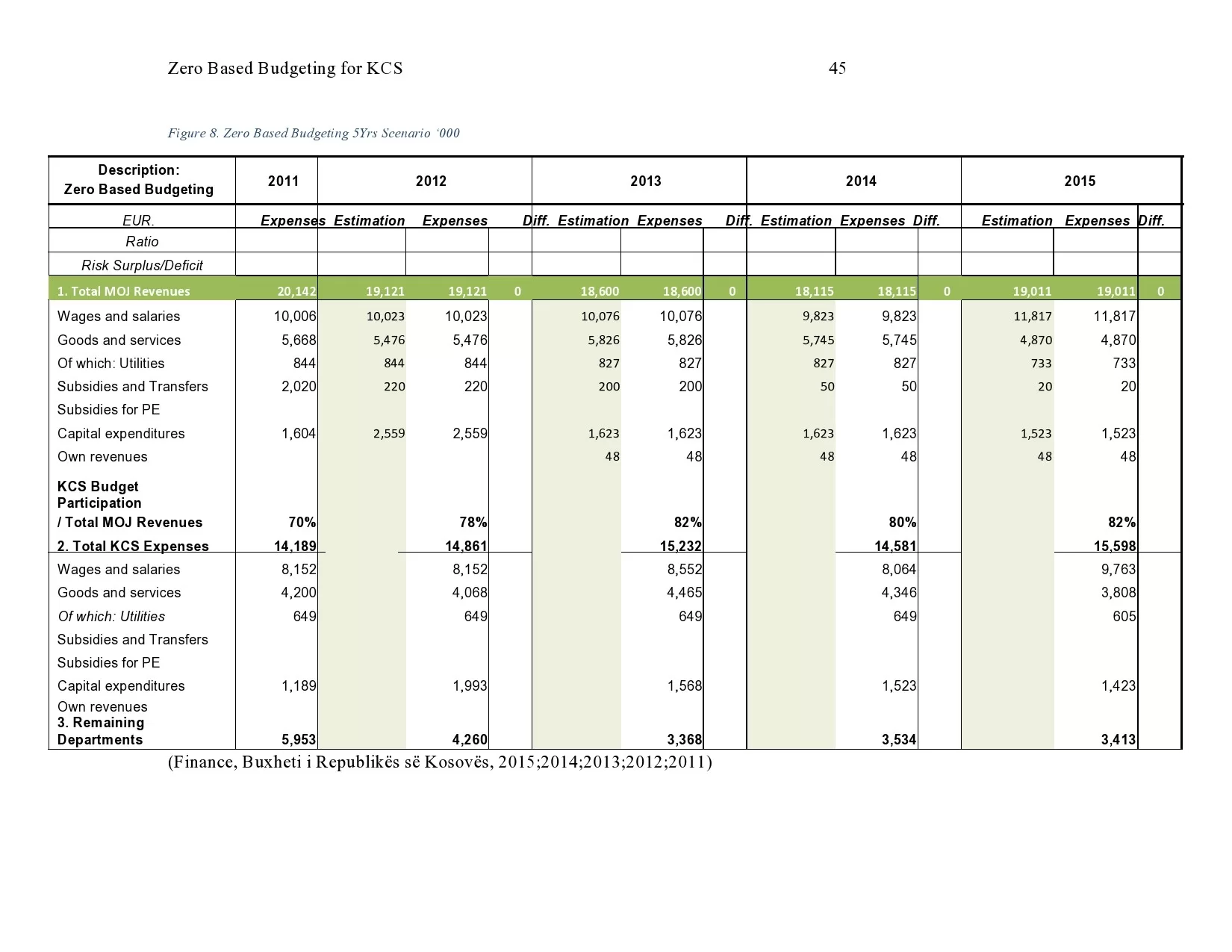

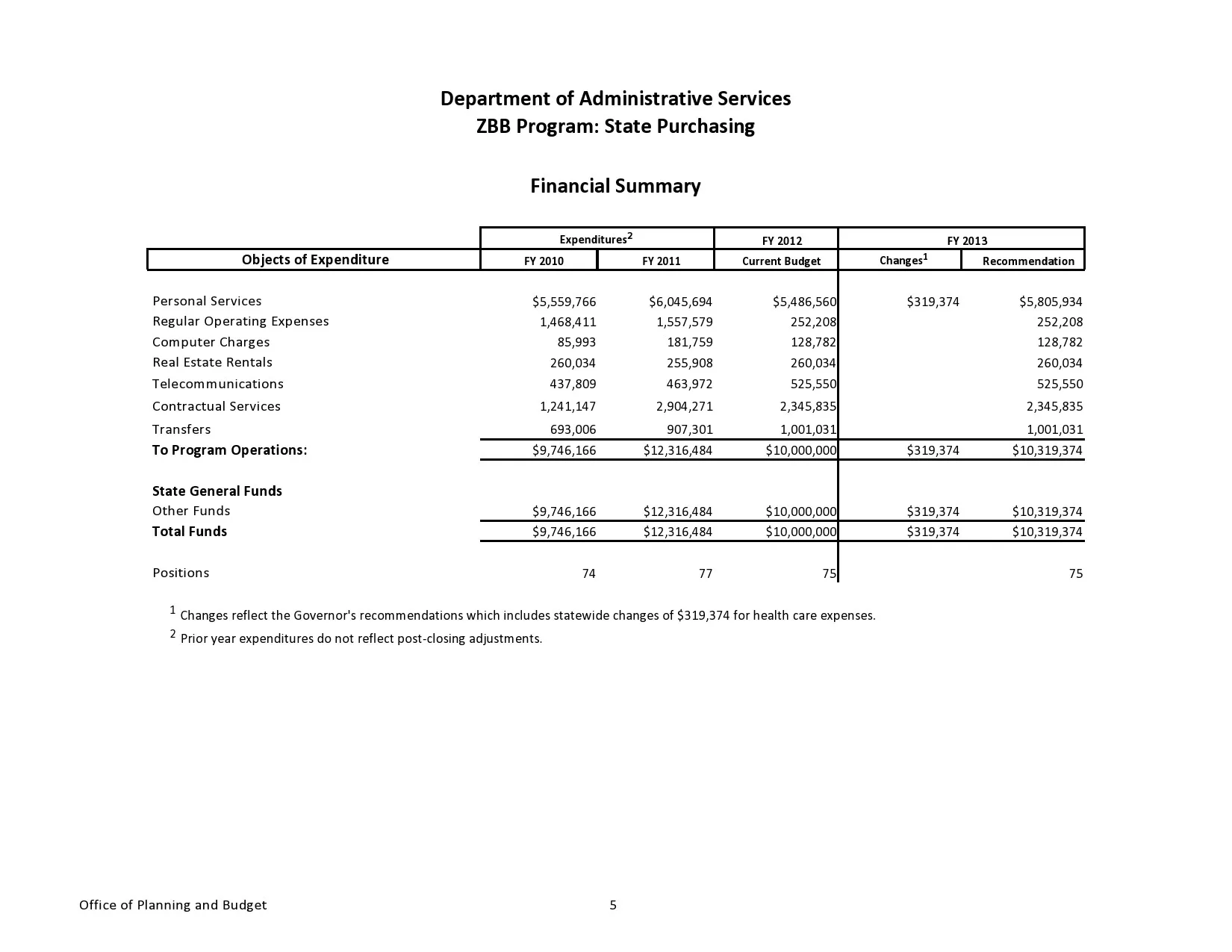

Zero-based budget planning happens when everything in each budget period (the financial year or month) is justified because no dollar will be spent unless it is a specific purpose for it. Unlike traditional budgeting, which adjusts the previous budget with a minor incremental change, zero-based budgeting begins from scratch. It builds from the ground analyzing income and expenses. This creates a standard for financial discipline, that is it removes unnecessary costs and optimizes resource allocation.

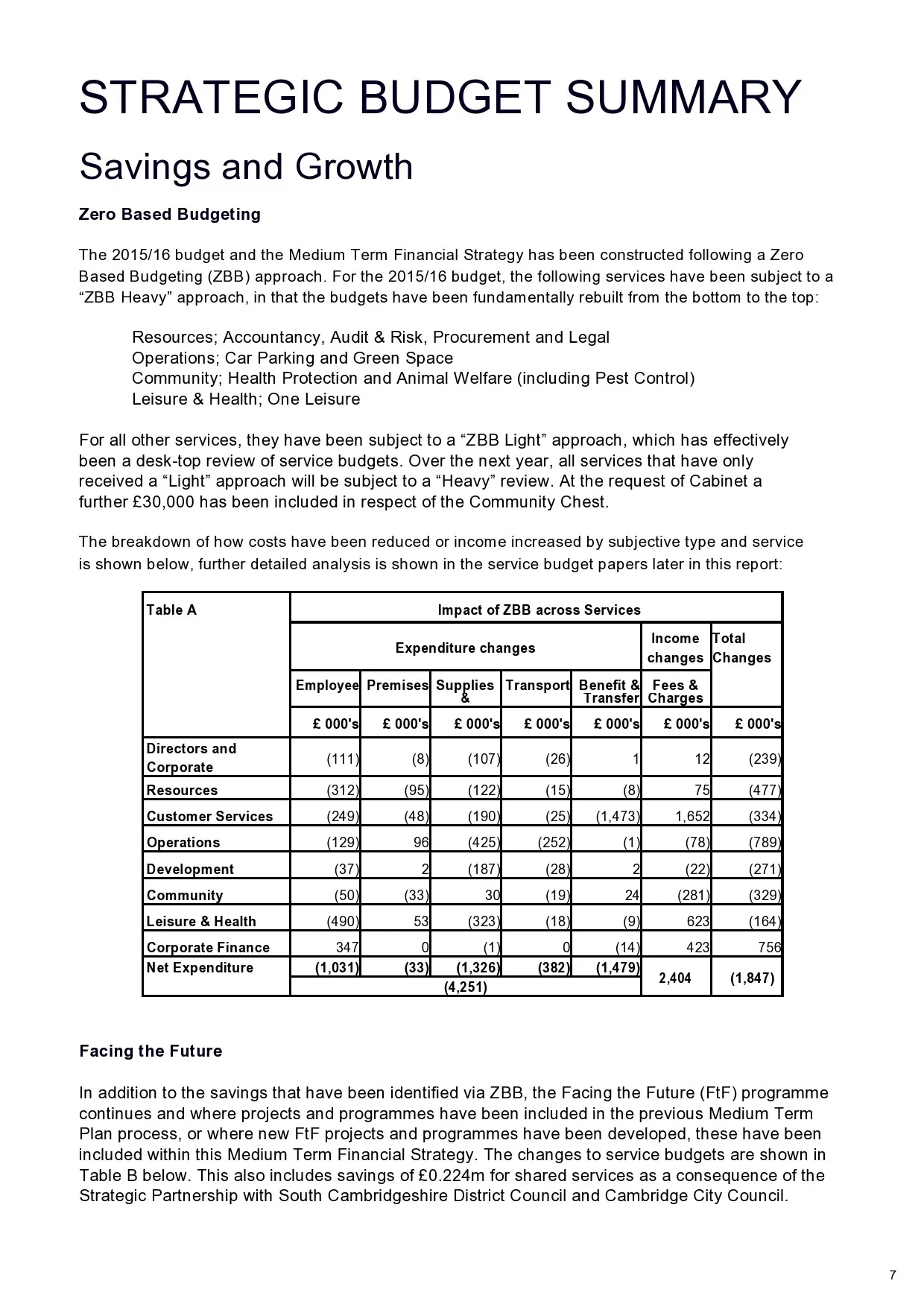

Zero-based budget planning is mainly applied by businesses and individuals who are seeking to show the most efficient financial use and who wish to maximize savings. All expenses are closely examined by organizations before they are approved so that they can prioritize spending, as actual needs dictate, rather than those dictated by historical patterns. Improved cost management in this case will save waste and ensure that funds are continually drawn towards the most important parts.

Zero-based budgeting can be of great benefit to businesses that want to streamline their operations, maximize profits, and exercise effective and stringent financial control. It allows individuals to exercise tighter control over their finances, enabling better debt tracking and longer-term savings. Its principles assure accountability and transparency in all financial dealings.

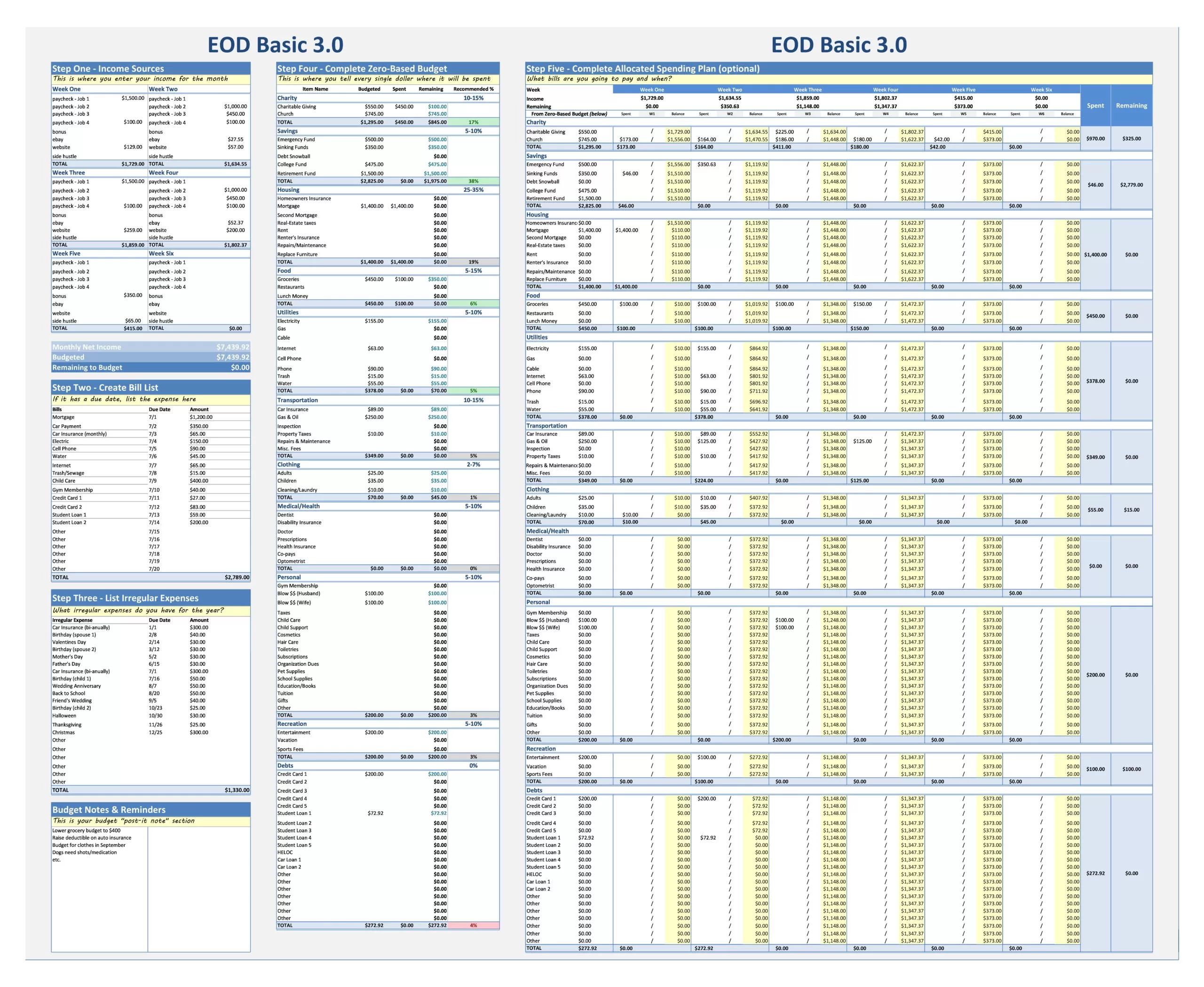

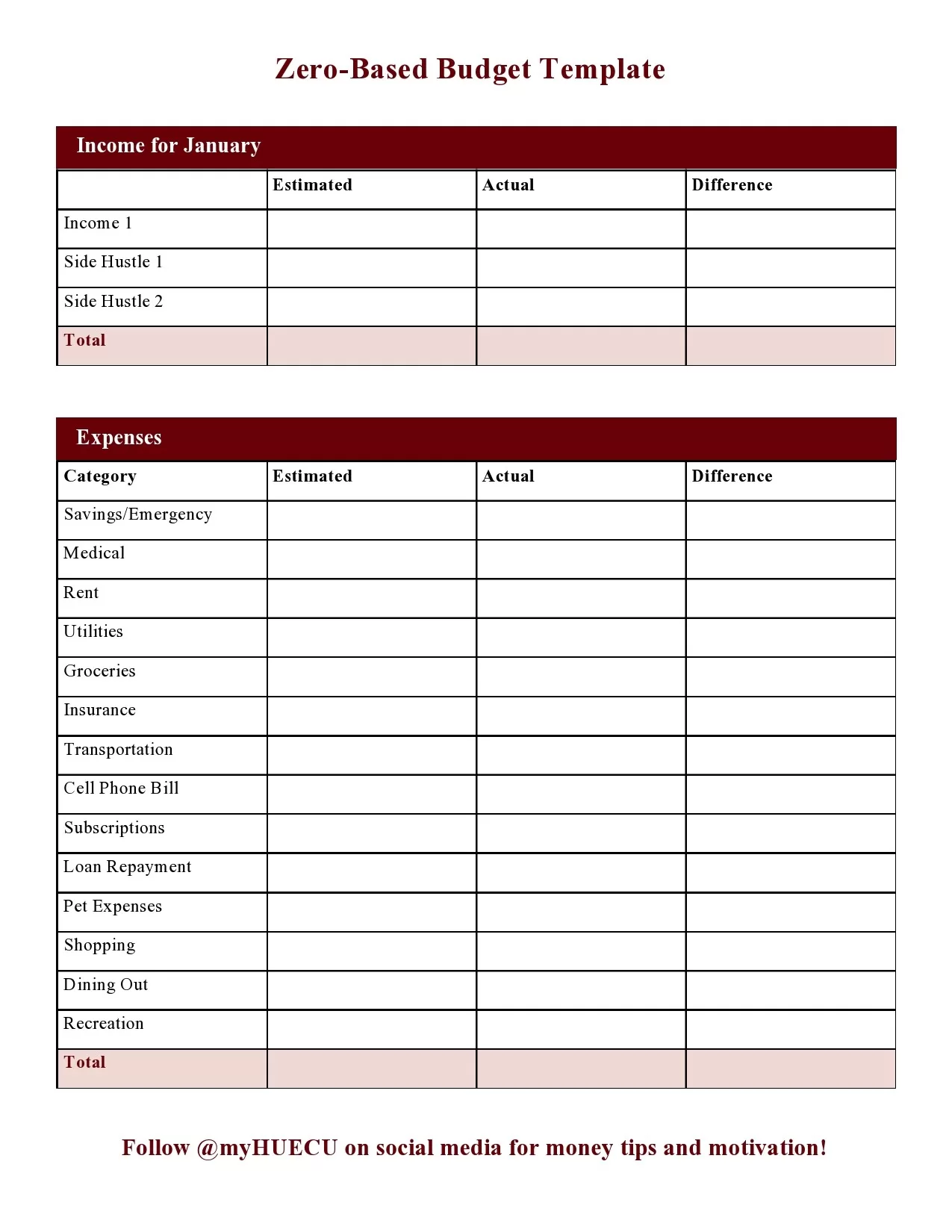

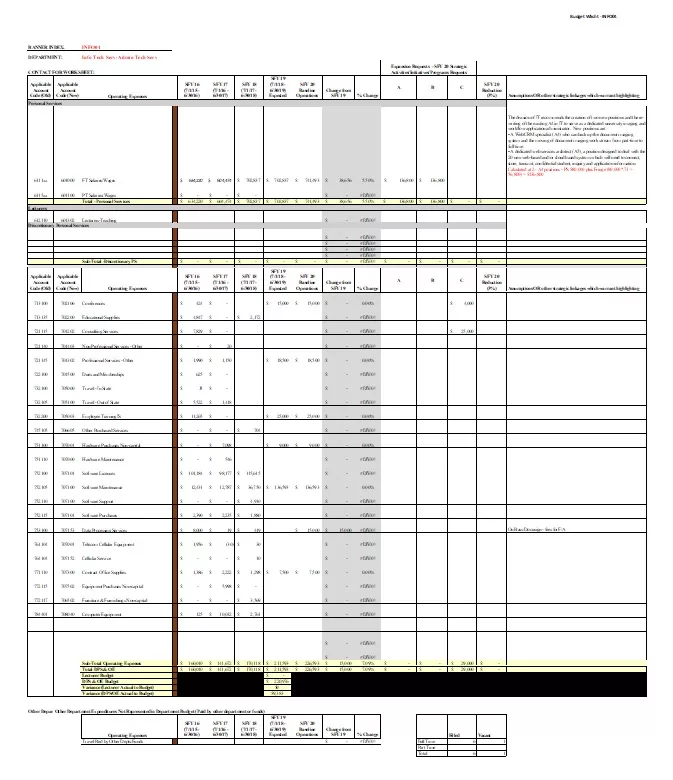

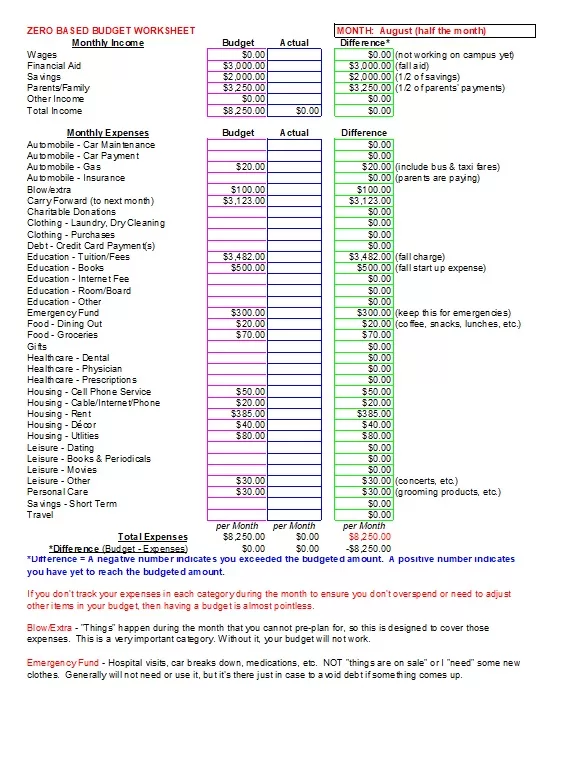

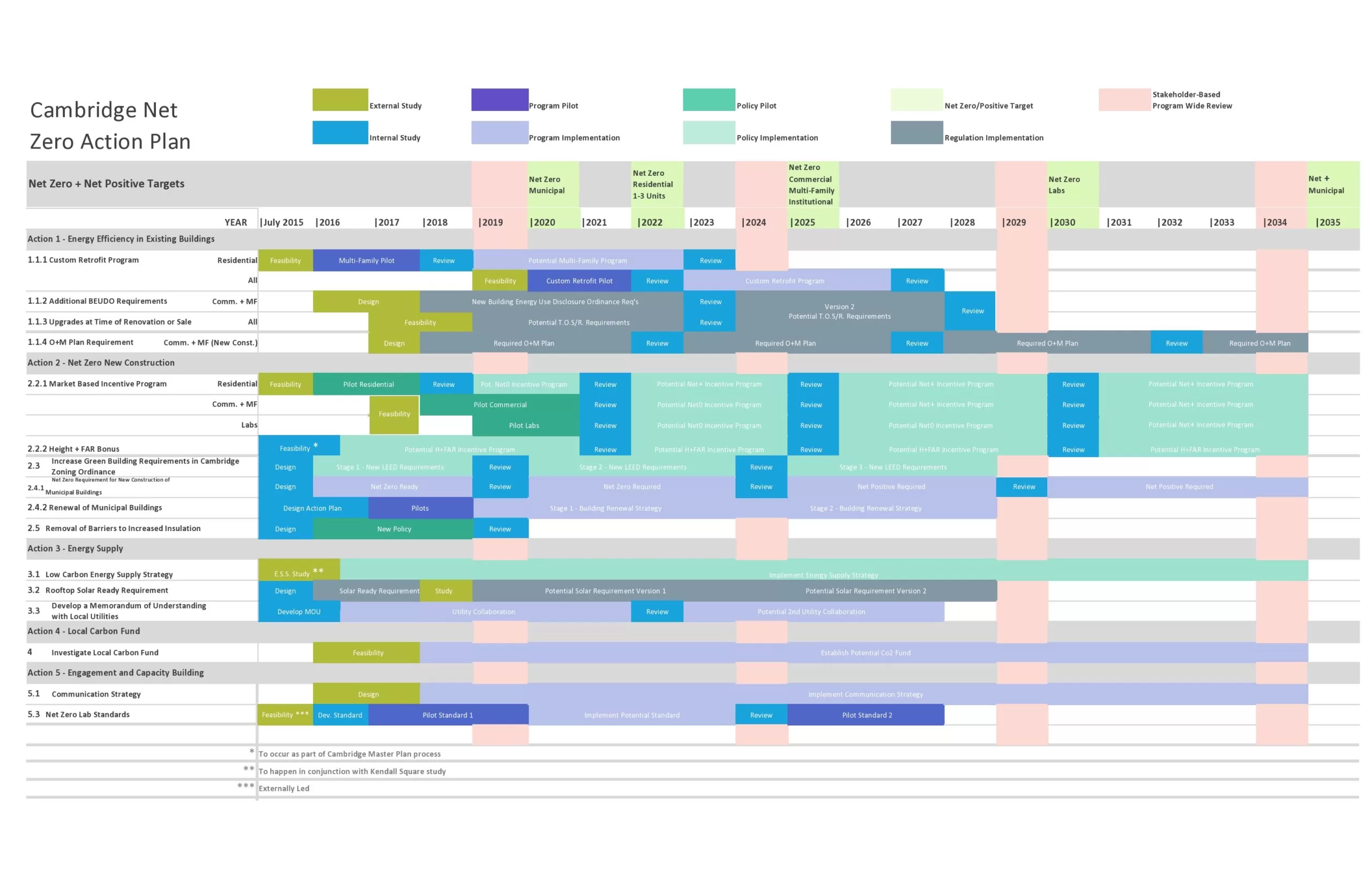

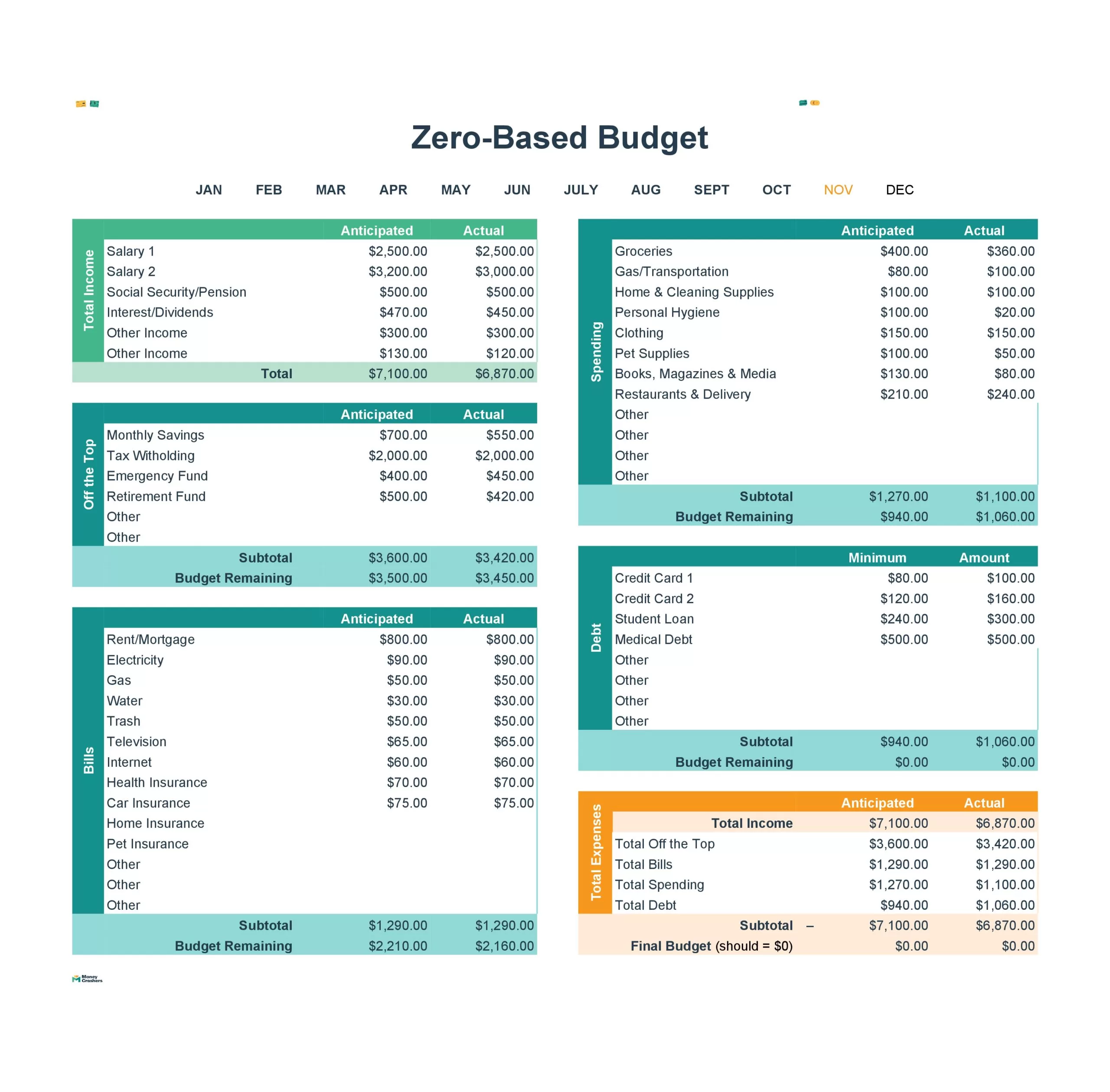

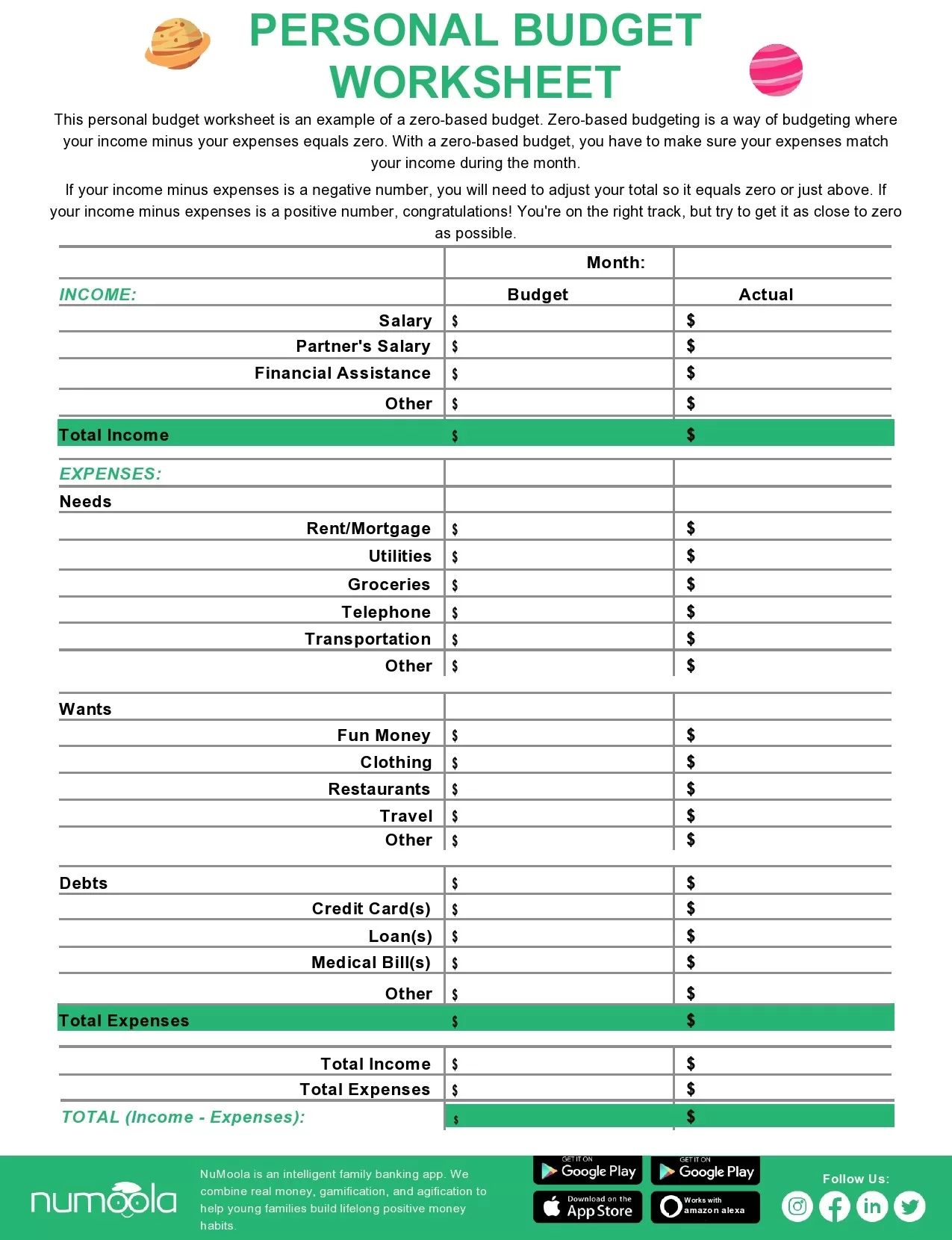

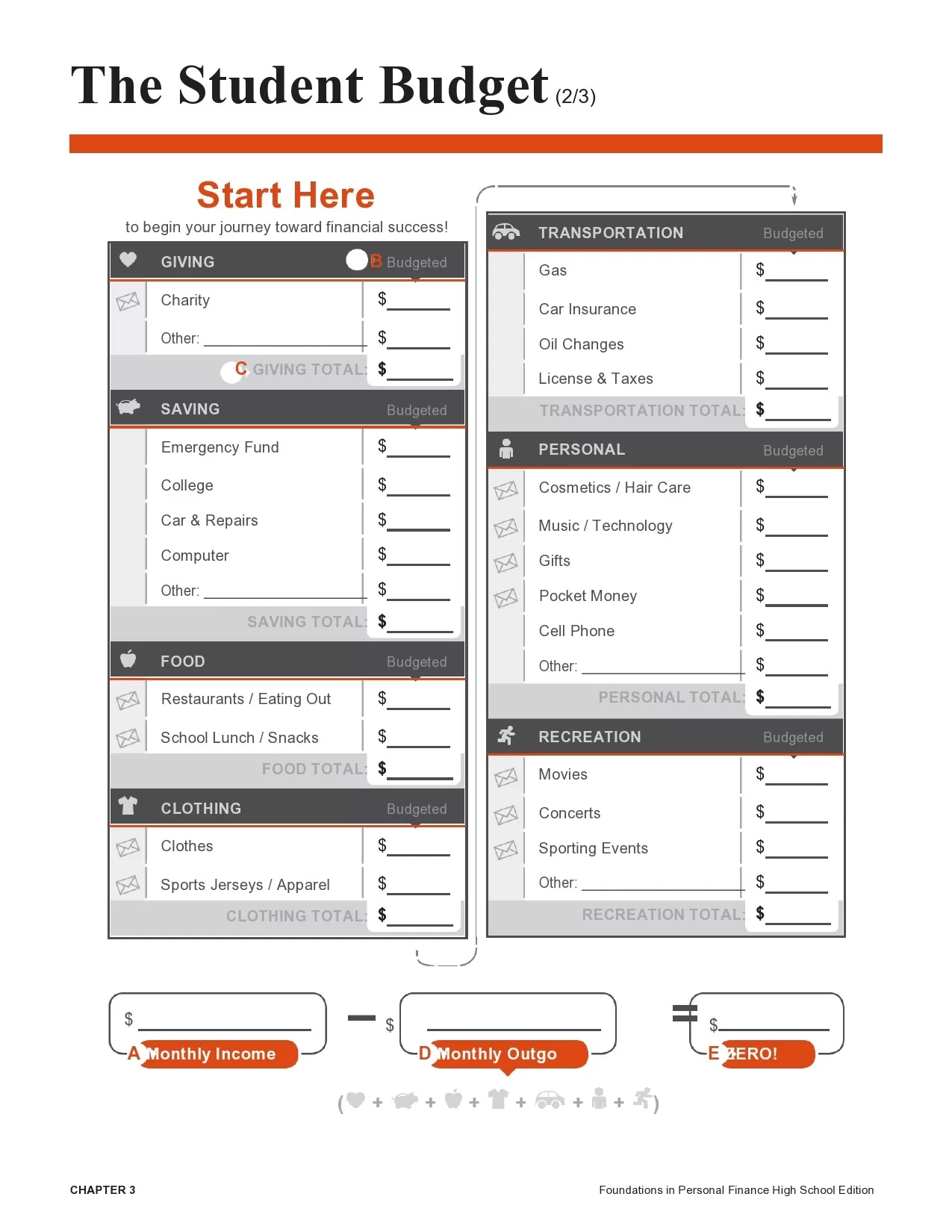

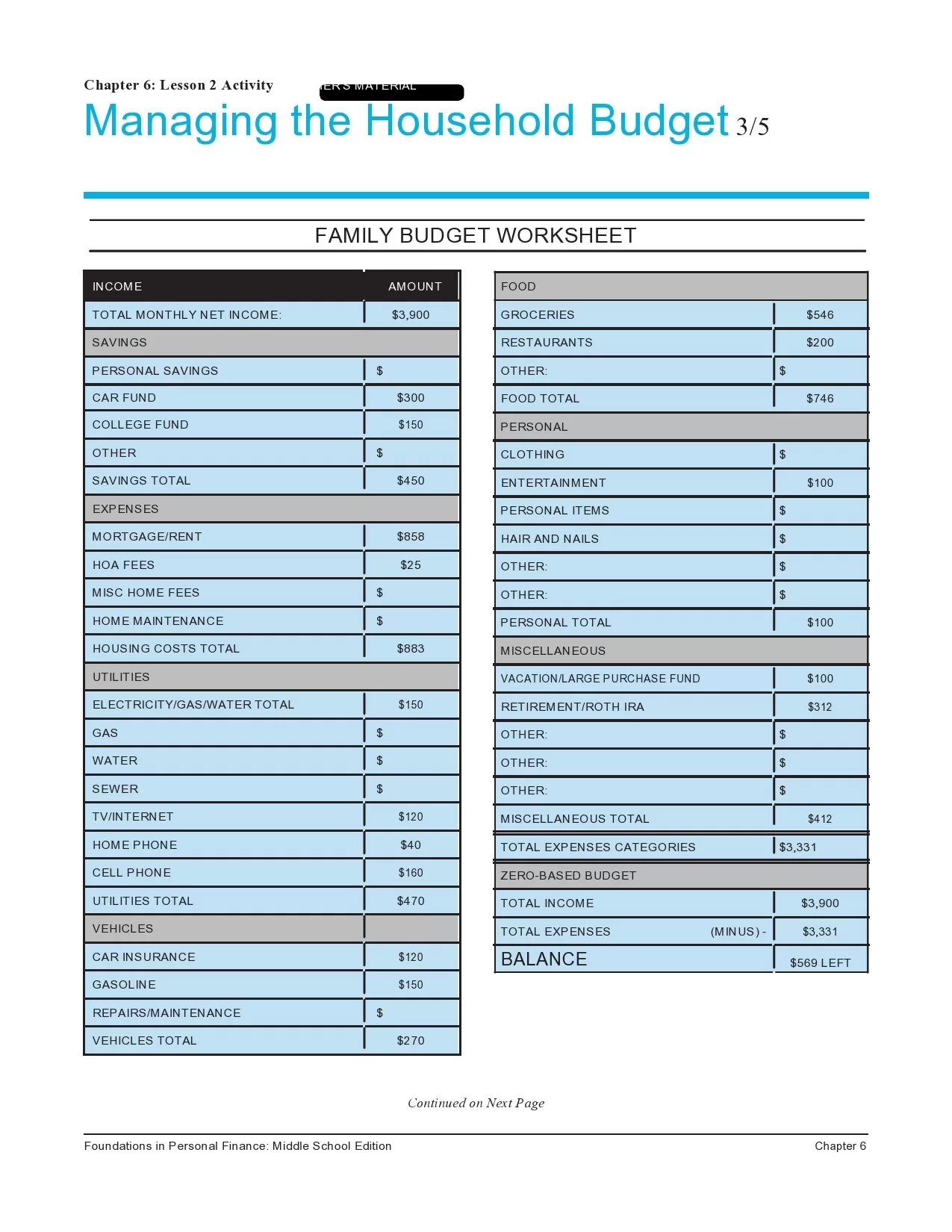

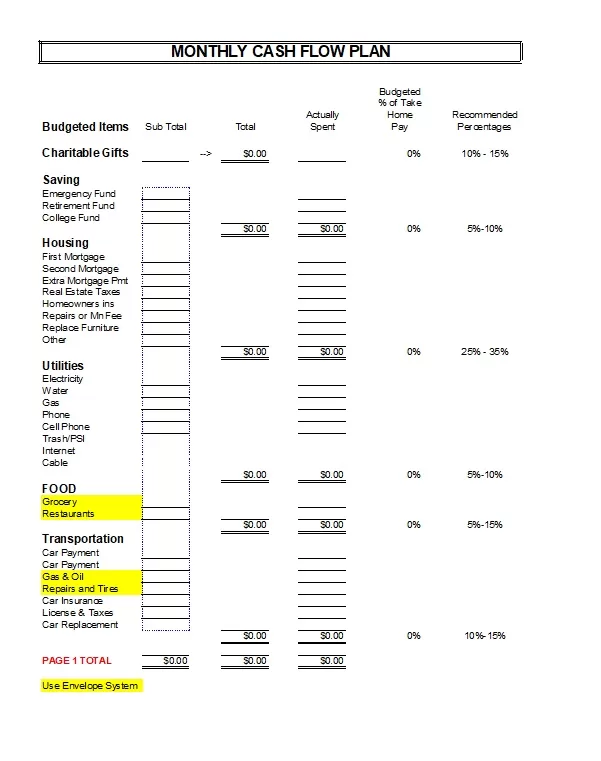

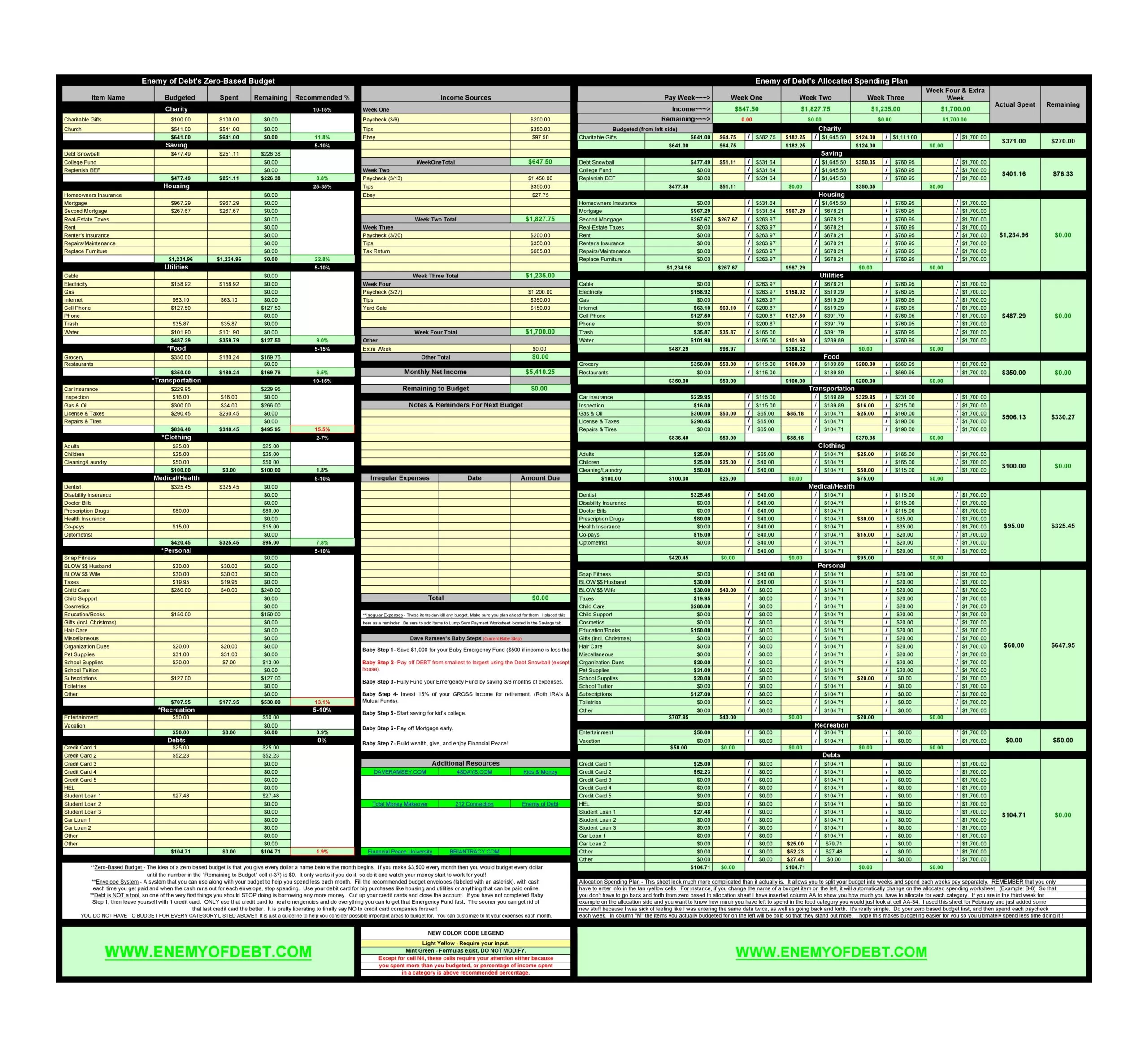

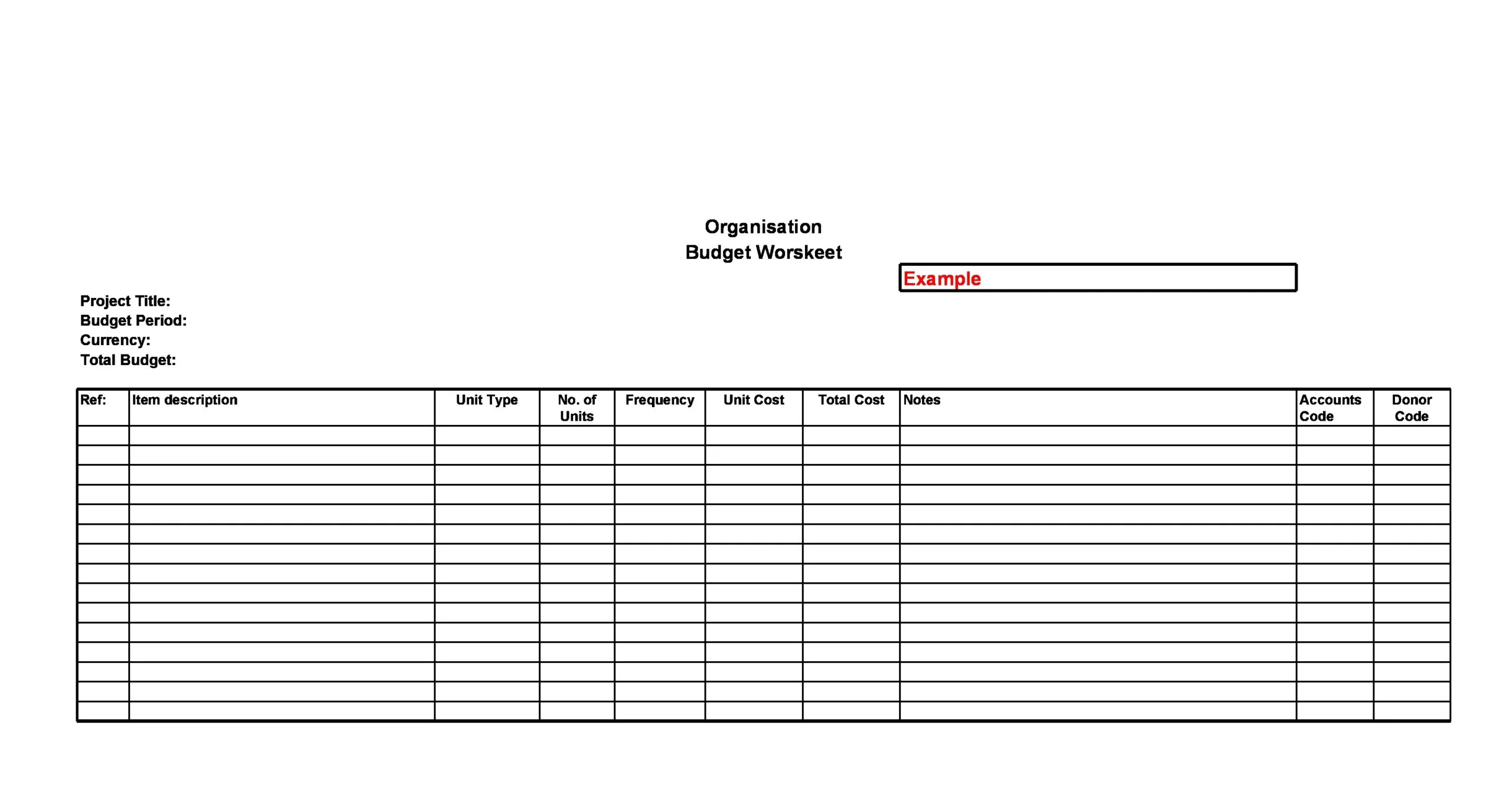

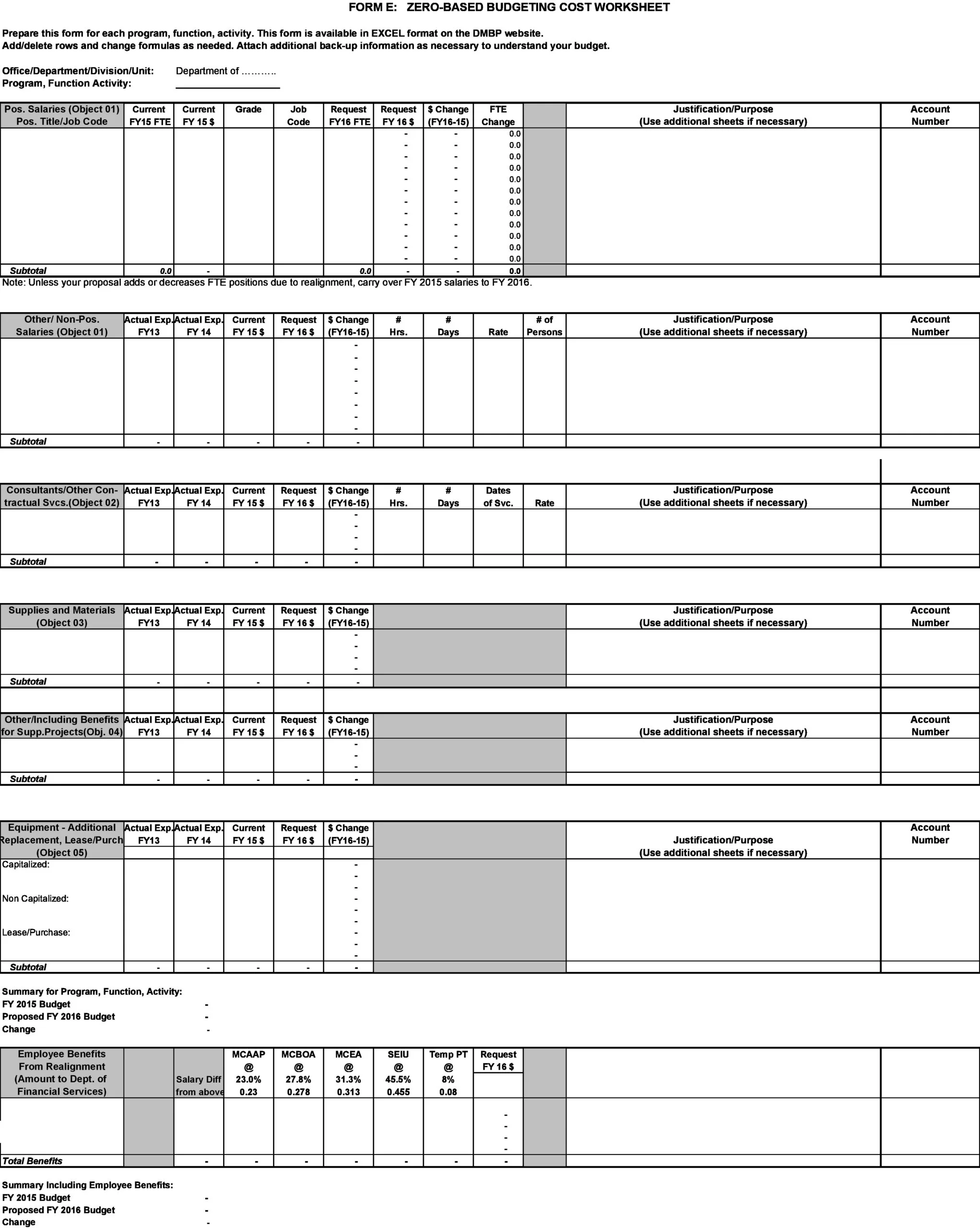

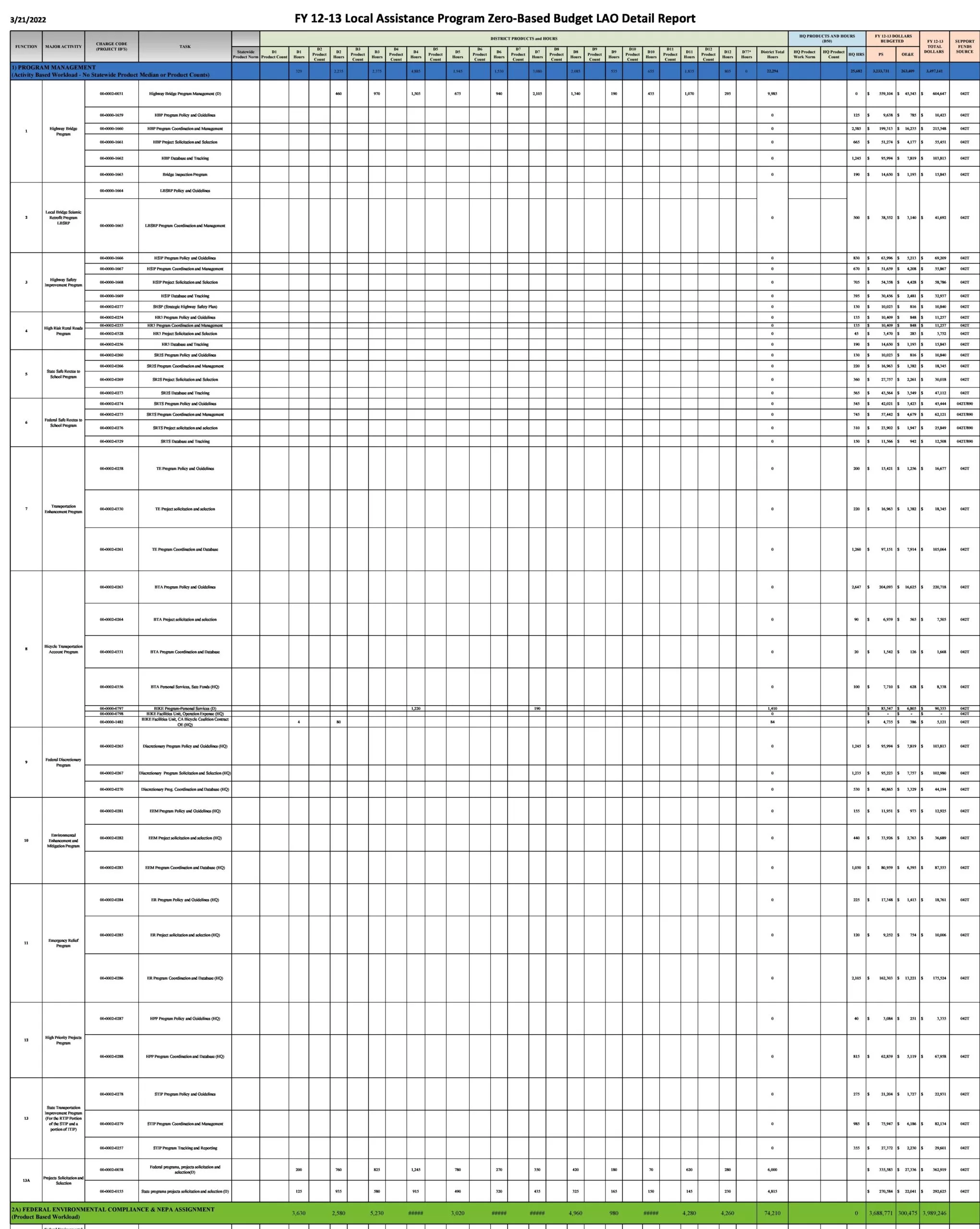

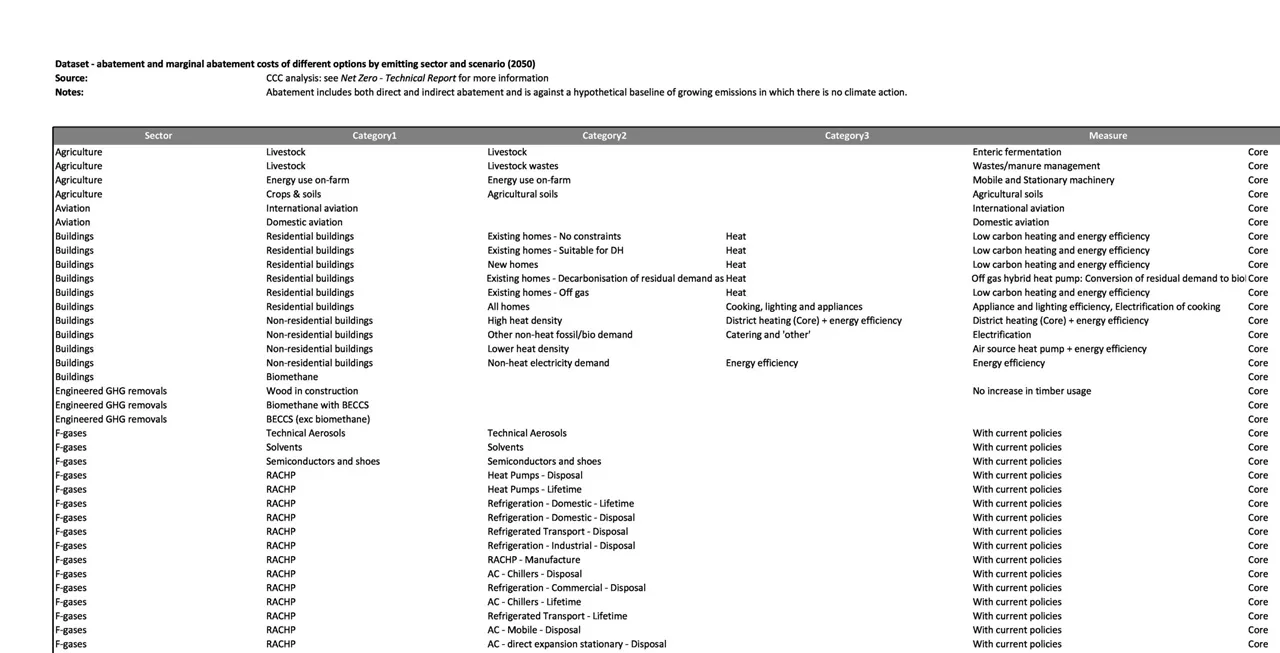

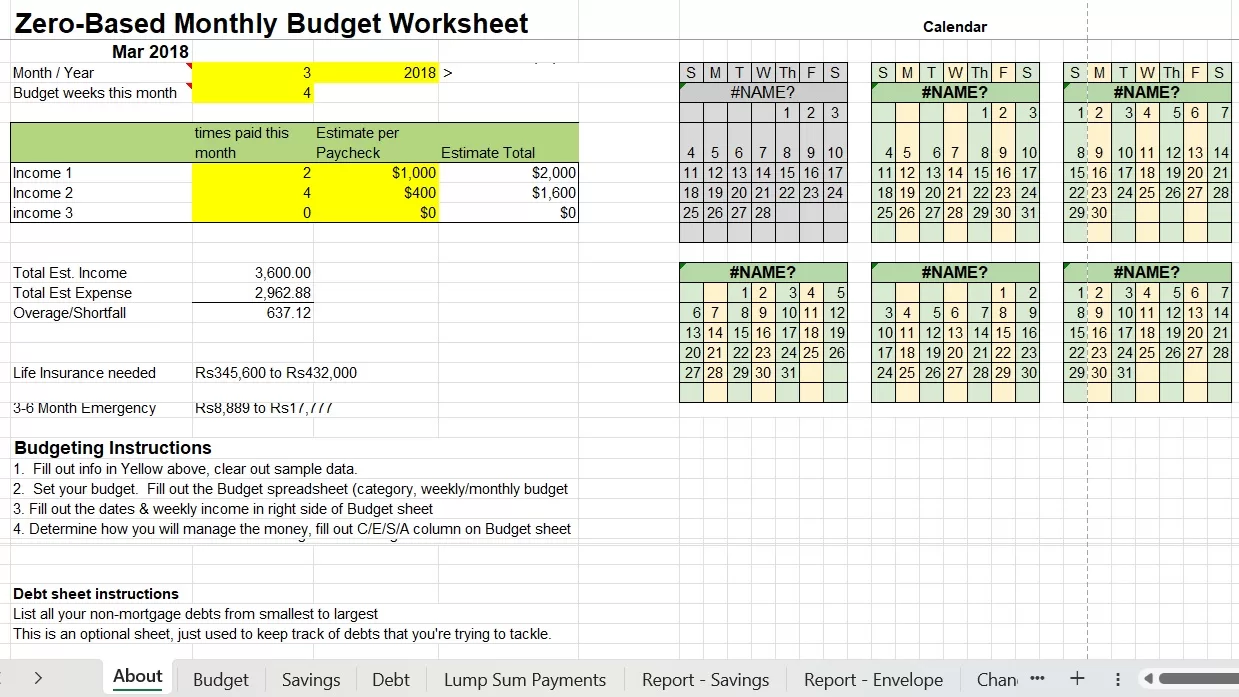

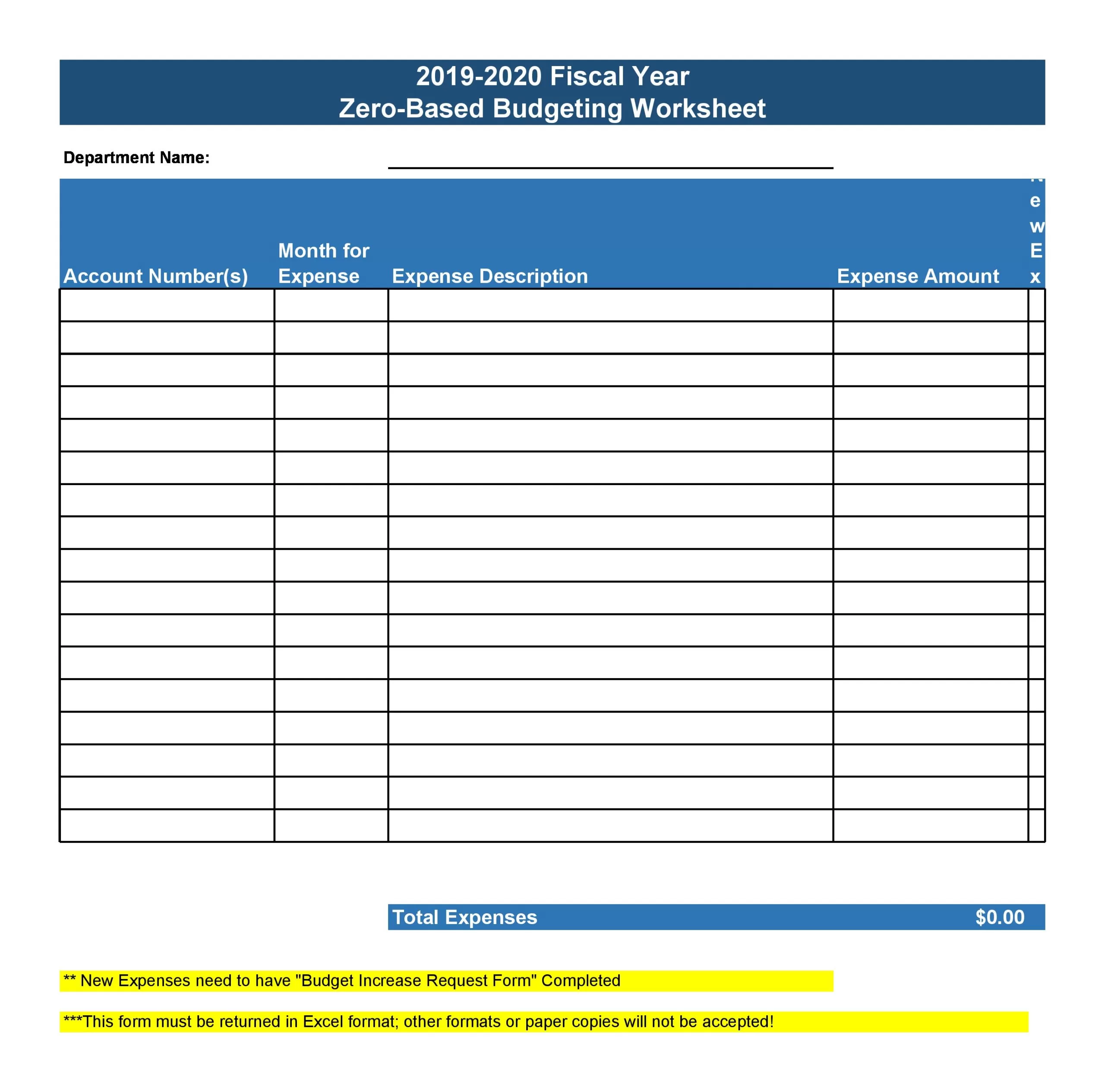

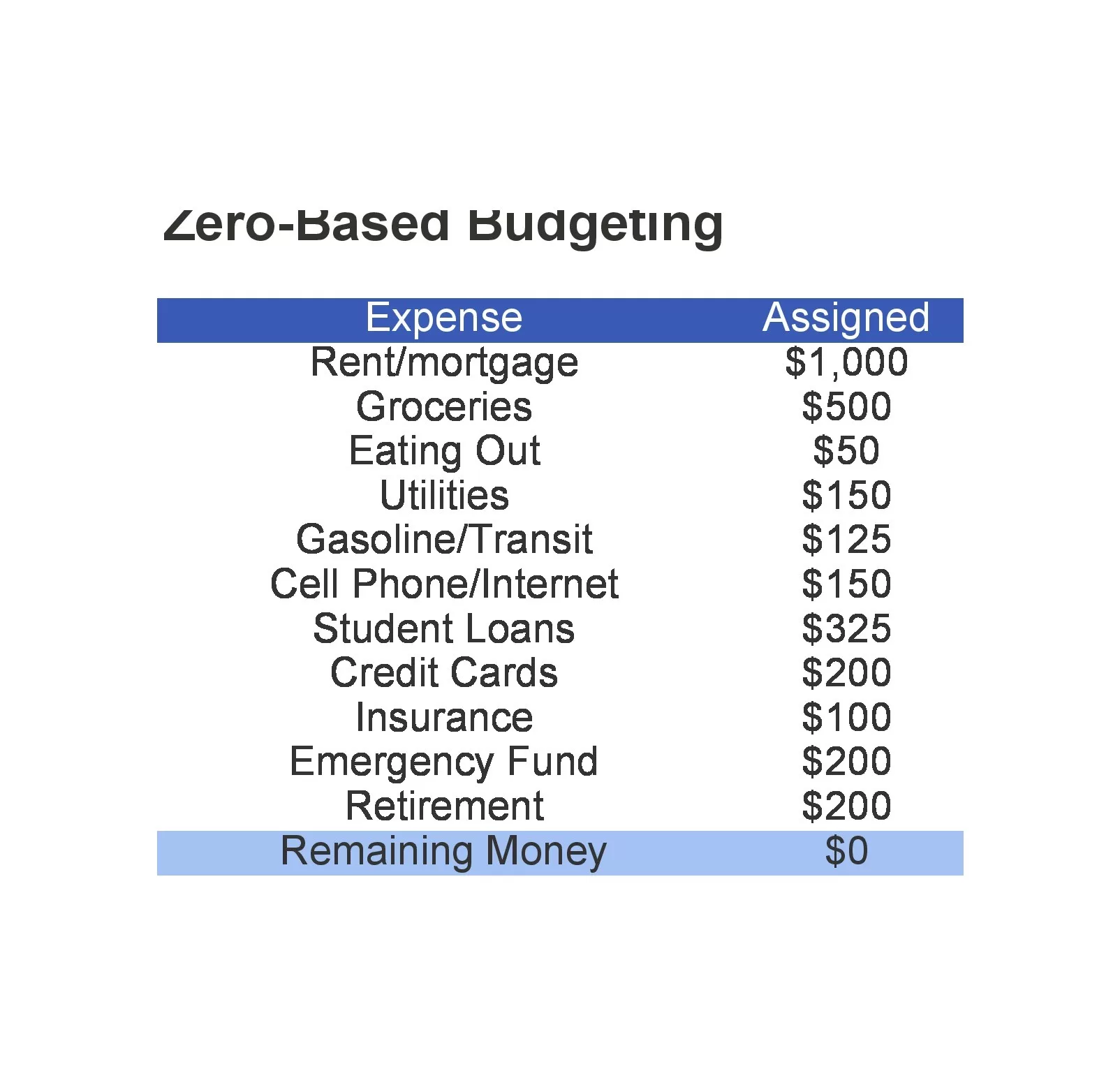

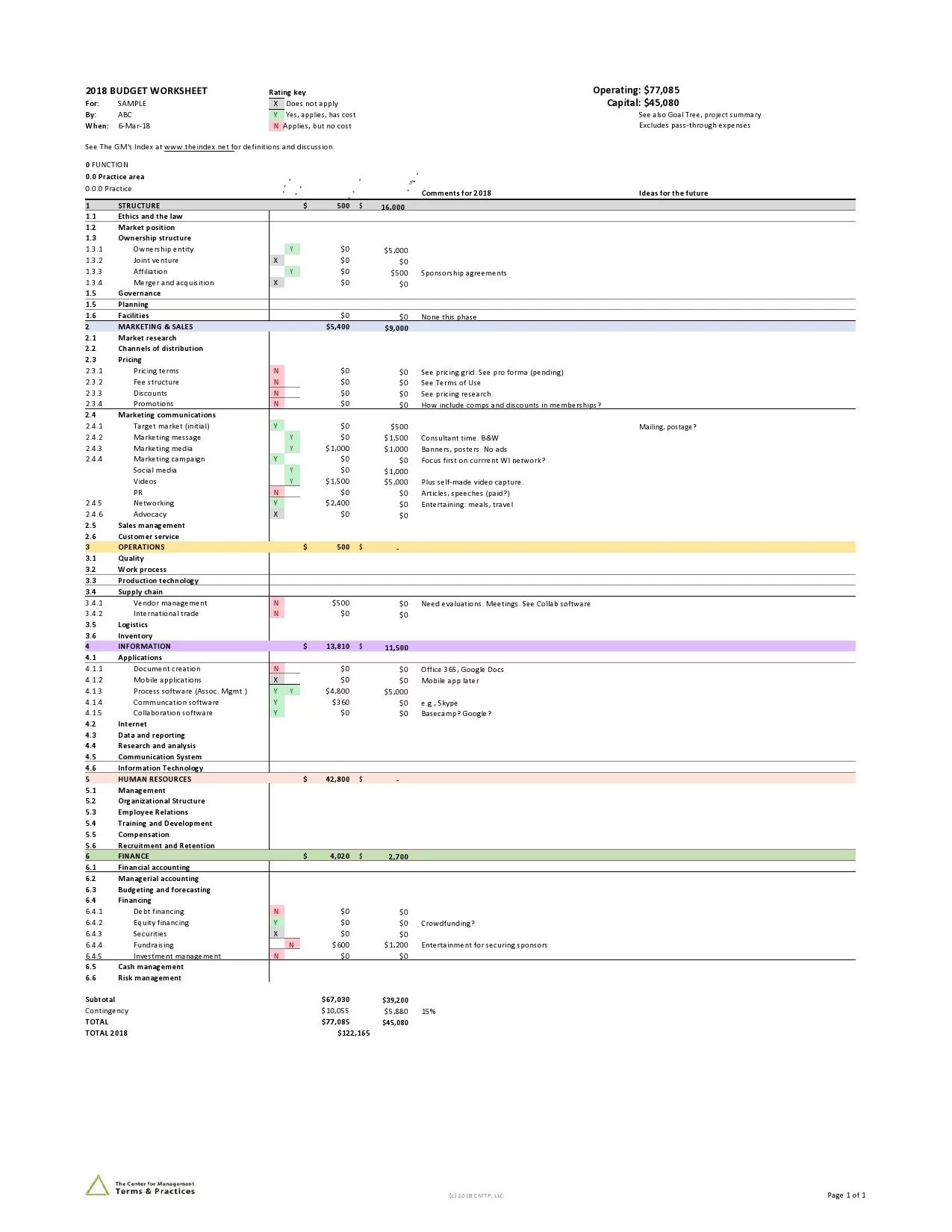

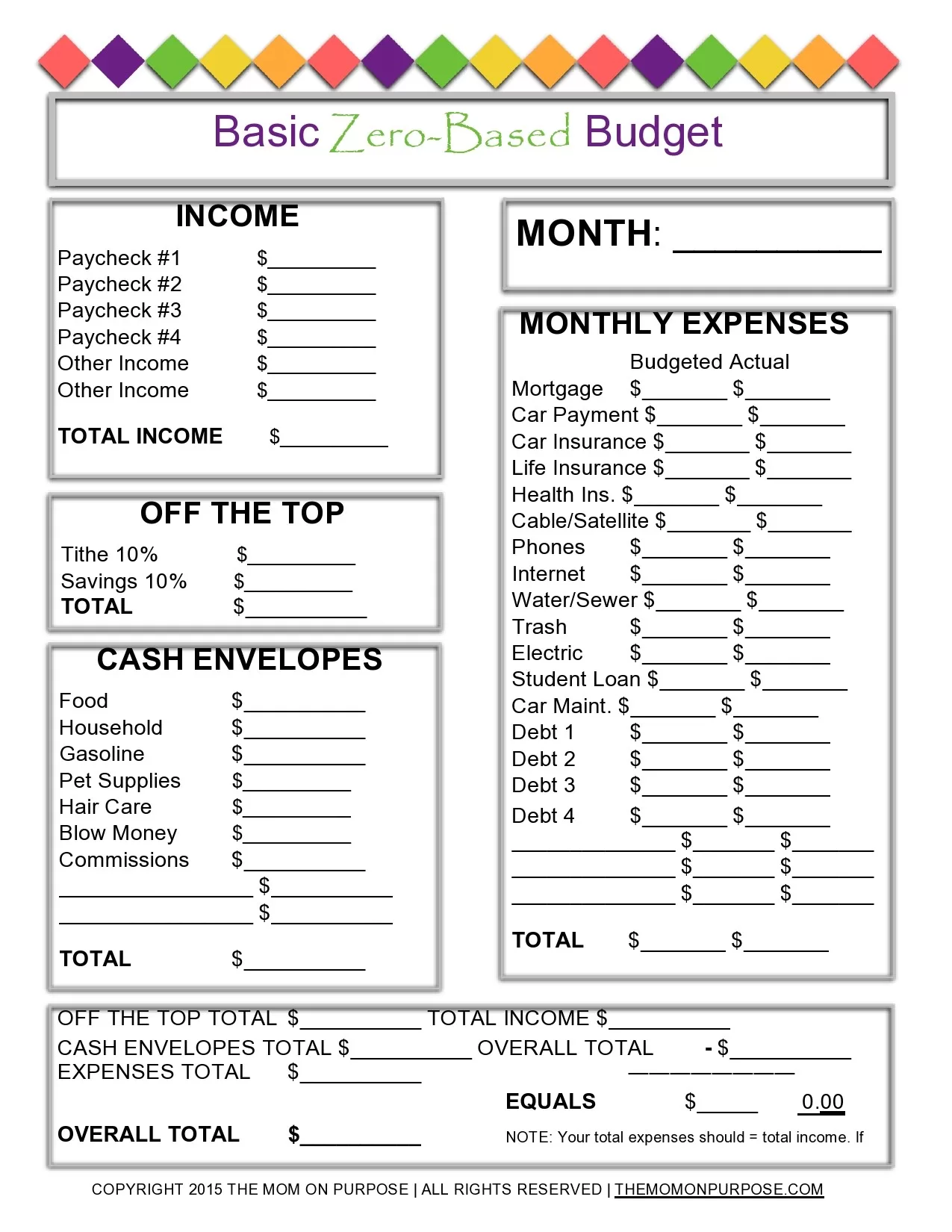

Download Zero-based Budget Sheets

Here are previews of our selected free Zero-based Budget Planning Sheets,

Guidelines to Prepare Zero-Based Budgets

The first step in preparing a zero-based budget is to clearly define financial goals and spending priorities. Whether for personal finance or business operations, having a clear understanding of objectives helps in structuring a budget that aligns with financial needs. Individuals may focus on reducing debt, increasing savings, or controlling discretionary spending, while businesses prioritize operational costs, growth investments, and profitability. Establishing these goals ensures that funds are allocated efficiently and every expense is justified based on necessity rather than past spending habits.

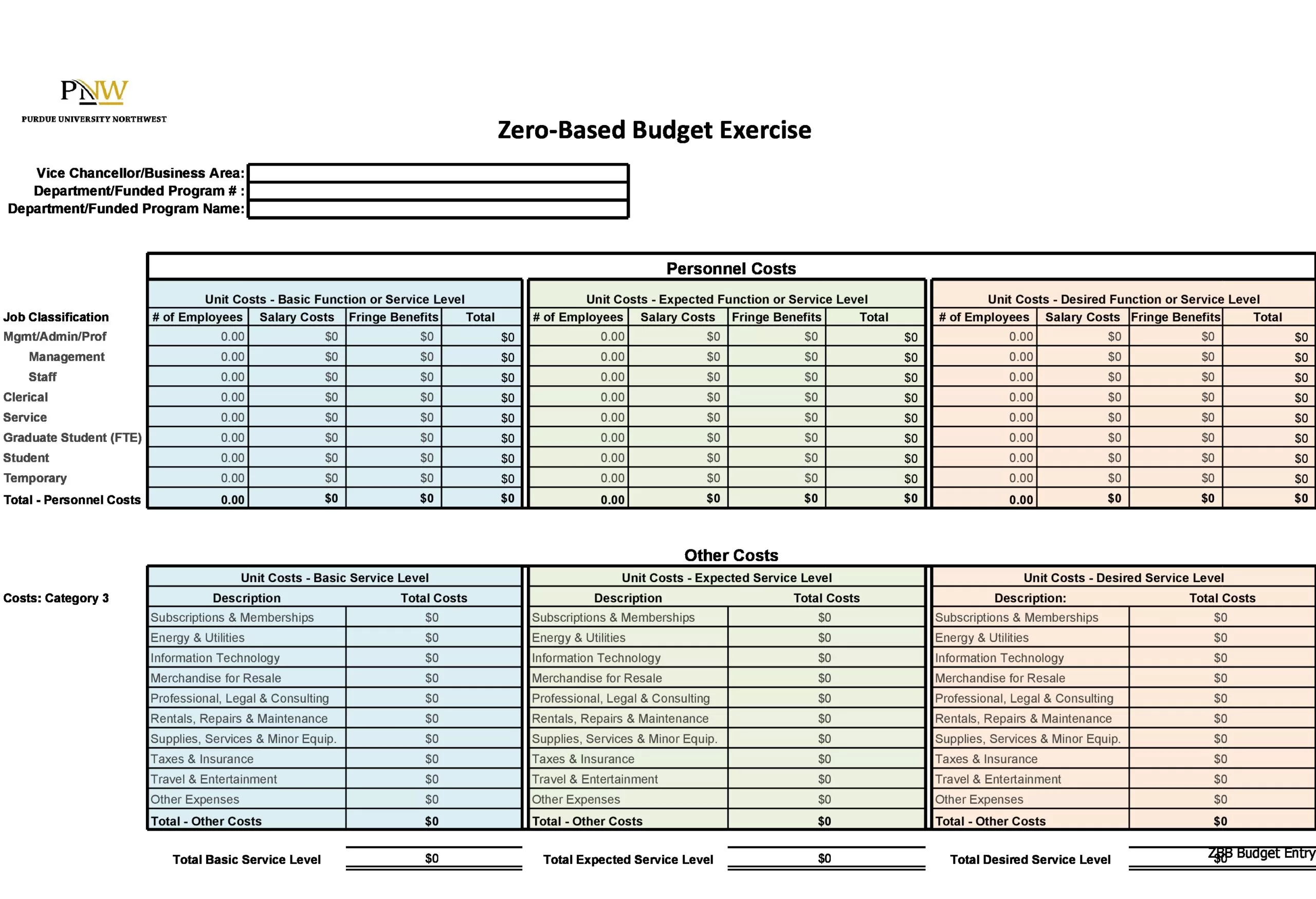

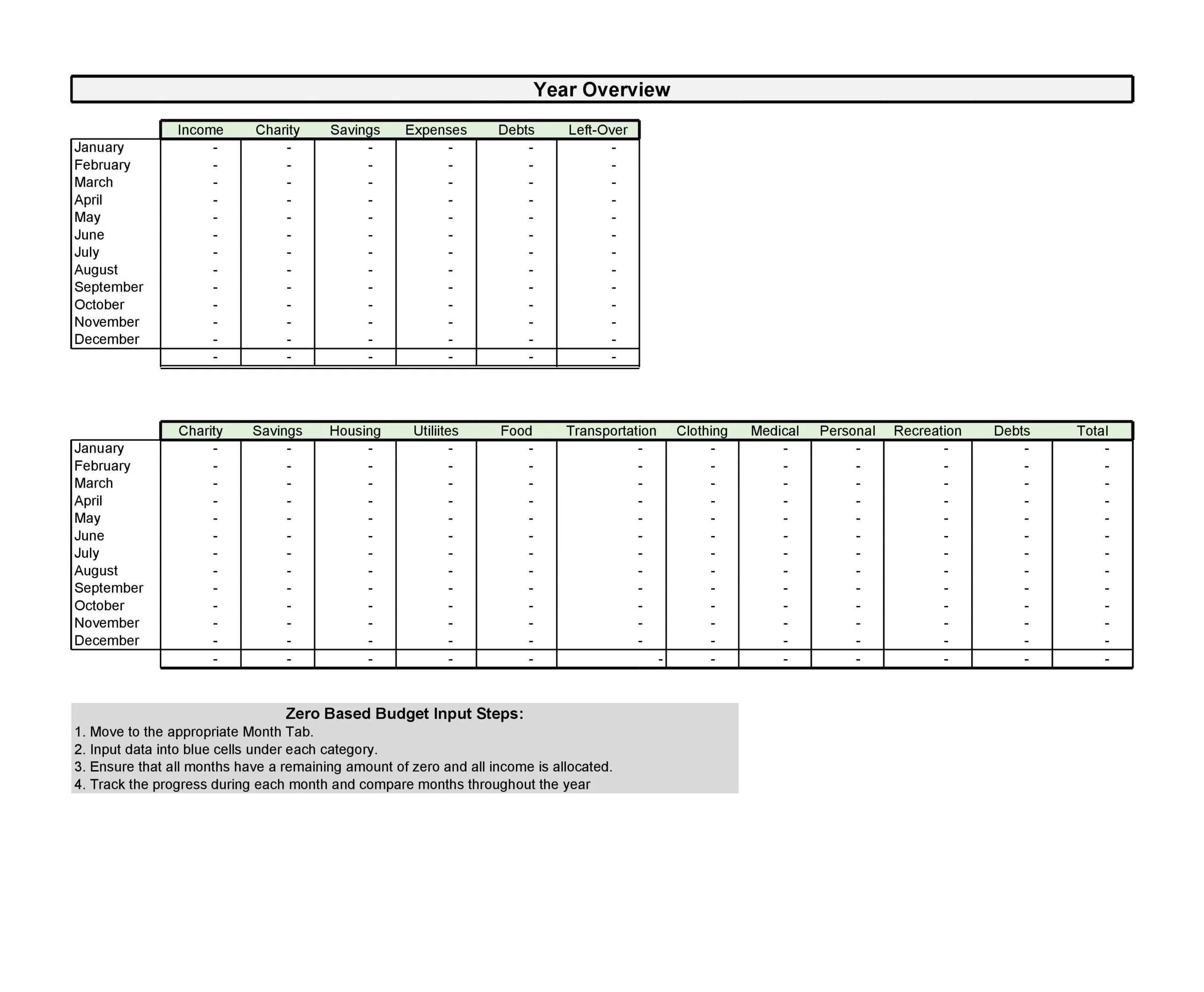

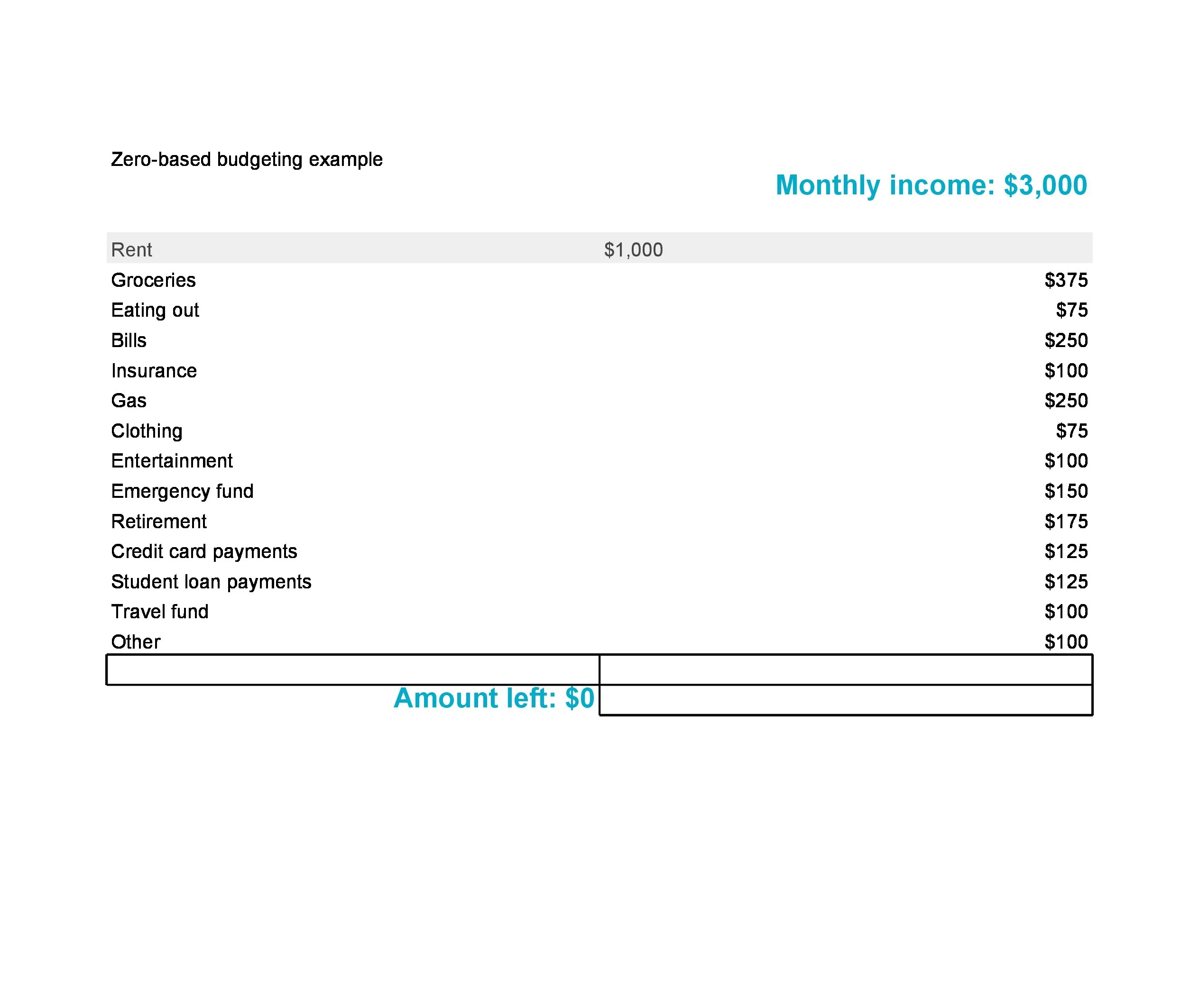

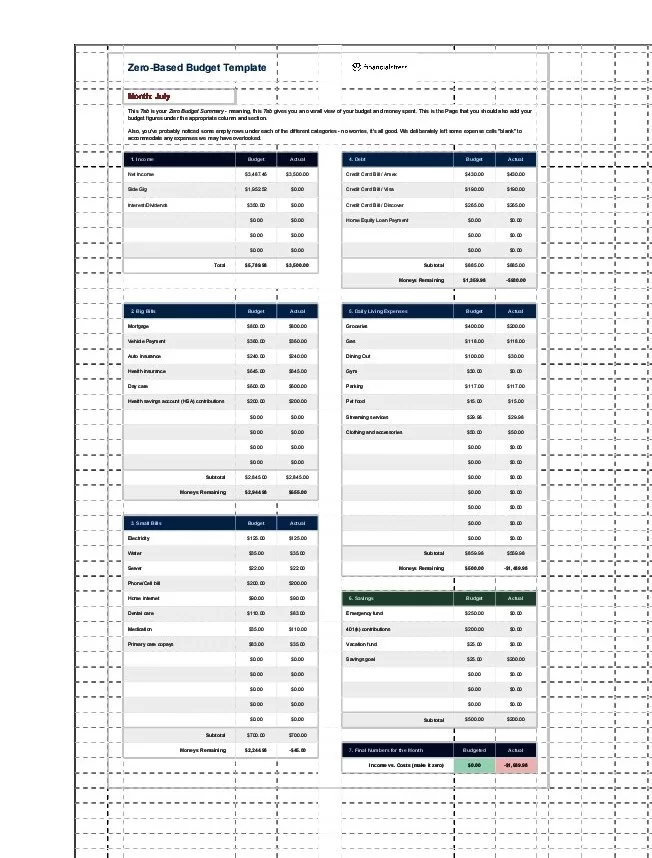

A zero-based budget requires an accurate understanding of all available income sources before allocating expenses. For individuals, this includes salaries, freelance earnings, rental income, or any passive revenue. Businesses must account for sales revenue, investments, and other income streams. By identifying total earnings, the budget can be structured to allocate funds effectively, ensuring that every dollar has a purpose and financial stability is maintained throughout the budgeting period.

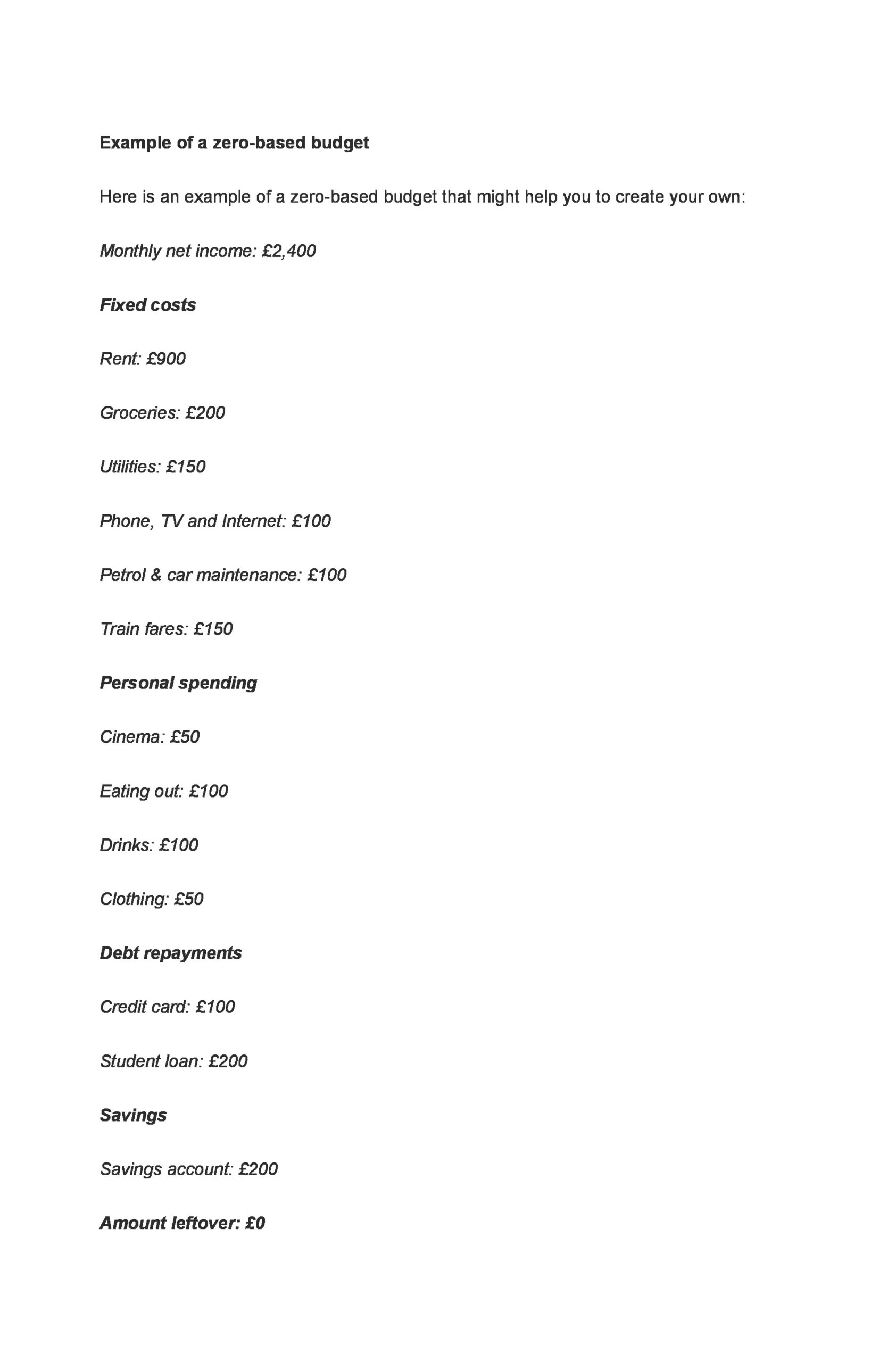

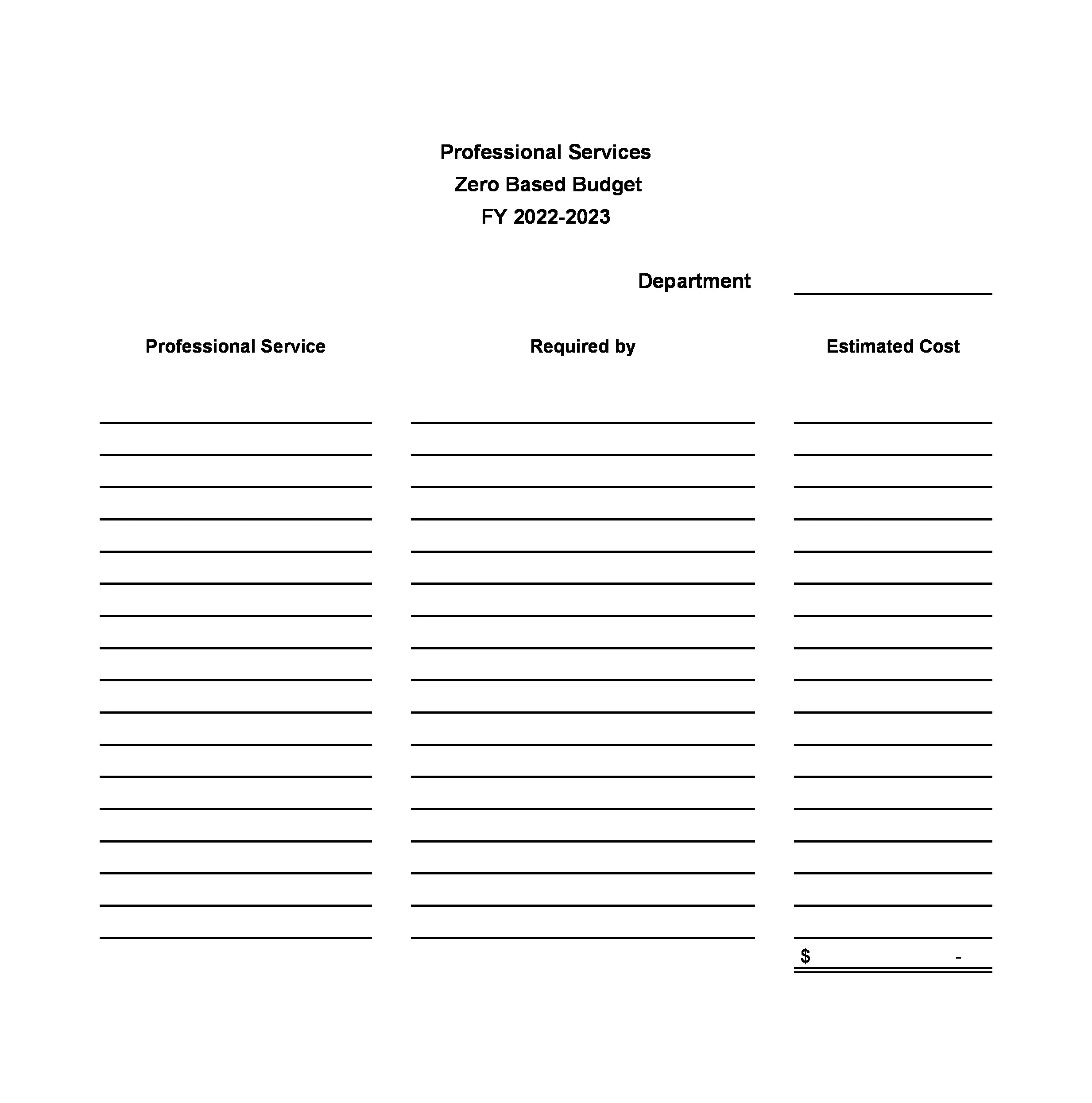

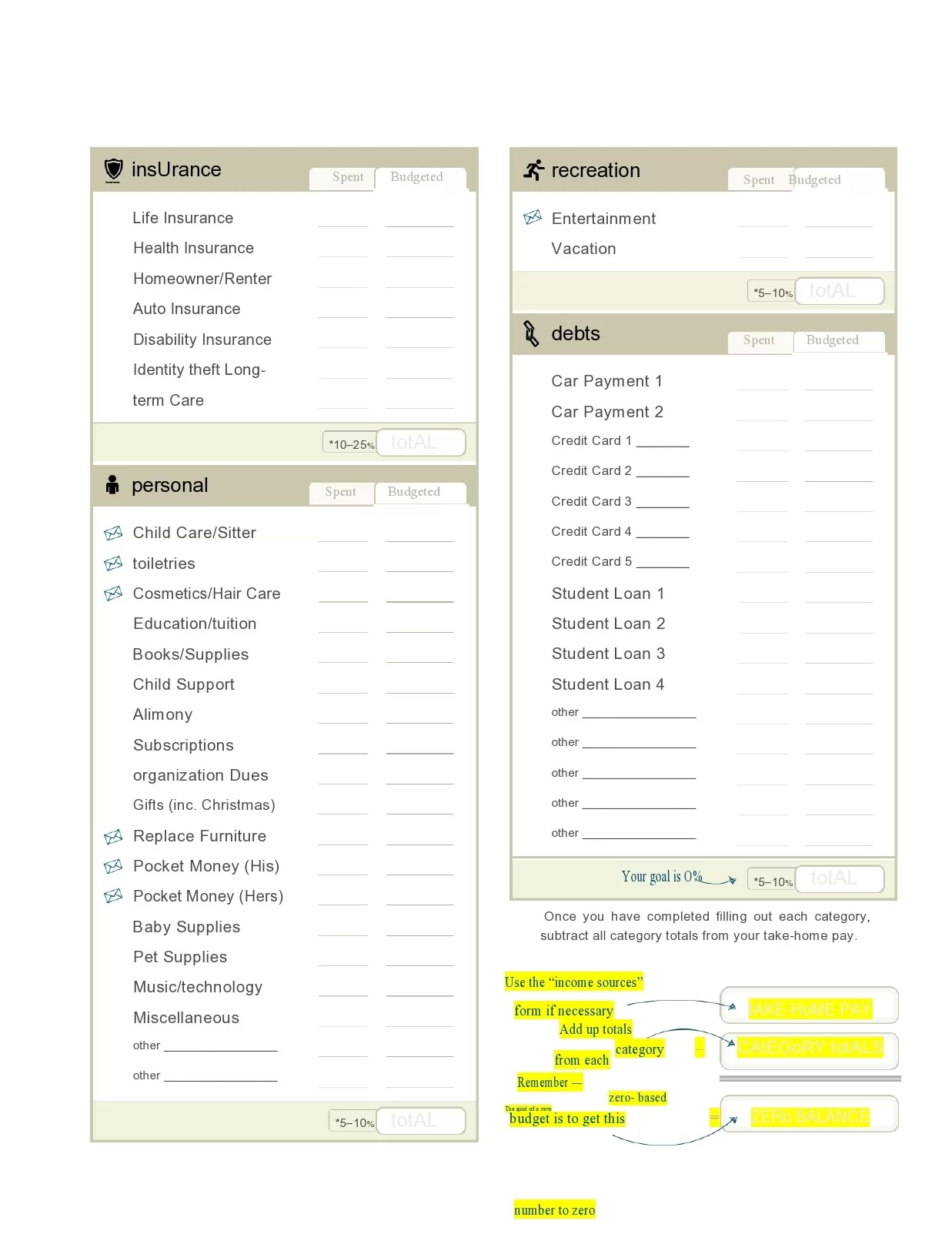

Unlike traditional budgeting, which adjusts previous budgets with minor changes, zero-based budgeting requires listing all expenses from the ground up. Each expense must be analyzed and justified to determine whether it is necessary for achieving financial goals. For personal budgeting, this includes rent, utilities, groceries, transportation, and entertainment. In business budgeting, expenses may include salaries, marketing costs, office supplies, and operational overheads. By justifying each expenditure, unnecessary costs are eliminated, allowing better allocation of financial resources.

Once all income and expenses are identified, funds must be allocated based on priorities. Essential costs such as rent, utilities, and loan payments should be covered first, ensuring that critical financial obligations are met. After covering necessary expenses, the remaining funds can be distributed toward savings, investments, or discretionary spending. In a business setting, funds should be assigned to departments or projects that align with company goals, ensuring optimal use of financial resources. The key to zero-based budgeting is to allocate every dollar, leaving no amount unaccounted for by the end of the budgeting period.

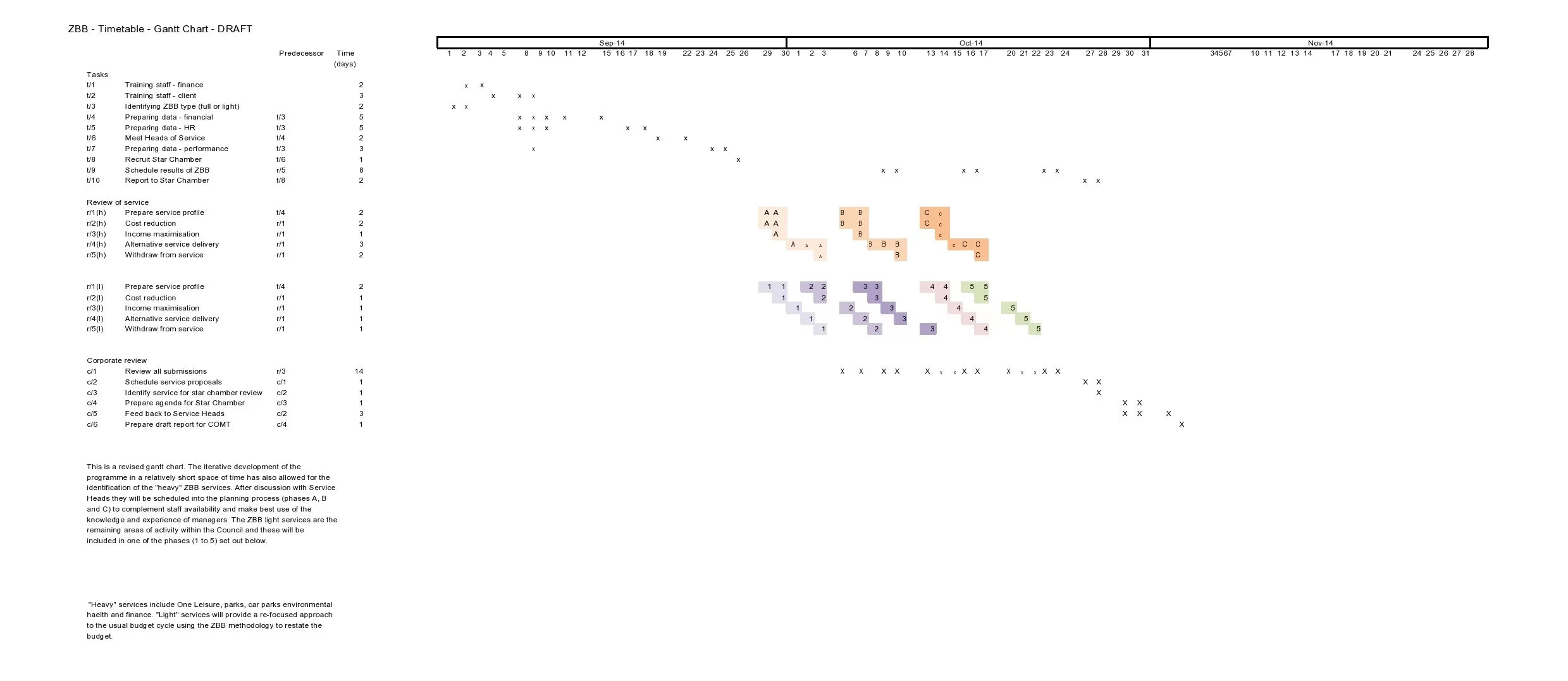

A zero-based budget is not a one-time financial plan but an ongoing process that requires monitoring and adjustments. Regularly reviewing the budget ensures that spending aligns with financial goals and that unexpected expenses are managed effectively. Tracking income and expenditures helps identify patterns, allowing adjustments to improve financial stability. Businesses should conduct periodic budget reviews to optimize costs, assess profitability, and ensure financial efficiency. By continuously monitoring and refining the budget, individuals and organizations can maintain financial discipline, avoid unnecessary spending, and maximize savings and investments.